3 Industries for Long Term Investing: Part 1 (E-commerce)

Stock picking has never been easy. Picking the right industry is one of the factors that will make an impact to your returns. Look at what is happening to oil prices and its effects on related industries. Look at how shipping companies have been affected by the shipping industry.

How Trend and Industry matters to a company

There are two schools of thoughts, each with their own merits. In chapter 8 of the bestseller, “One Up on Wall Street”, Peter Lynch shared that he prefers low or no-growth industries to high-growth ones as this is where he usually finds big winners, since no-growth directly leads to almost no competition and therefore ensures relative protection. The winners are usually the incumbents and they dominate a large market share.

Another school of thought is to spot a trend and ride on its rapidly growing industry. Although this attracts new entrants and competition, the industry’s growth could outpace new entrants. It could be easier to profit by picking a company within this rapidly growing industry.

Although these are extreme ends of how trends and industries matters, we employ both schools of thoughts to help form a picture for our analysis. Here is our three-part series on the 3 trends and industries for long term investing.

Trend #1: E-commerce – Making shopping cheaper and more convenient

Source: http://thenextweb.com/

Source: http://thenextweb.com/

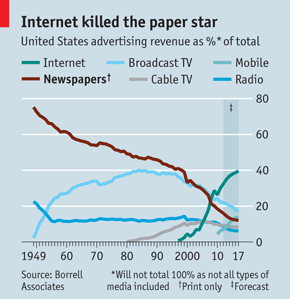

Tech stocks disrupted brick and mortar businesses in the early 2000s. Google, Yahoo, and recently Facebook broke traditional media and advertising business models. Based on The Atlantic, newspaper lost $16 in print ads for every $1 earned in digital ads. This caused the demise of many newspaper and printing companies, forcing the surviving ones to rethink and reinvent themselves.

These tech businesses were disruptive not only because they could reach out faster and were cheaper, but because they totally changed the way that people does things.

A new wave of disruptive innovation has arrived. With the proliferation of smart phones, users have become more connected to businesses through the internet, making e-commerce more accessible and convenient. We have seen listed e-commerce companies such as Amazon (AMZN), Ebay (EBAY) and recently IPO-ed Alibaba’s (BABA) sales and share prices skyrocket. Closer to home, we noticed how popular e-commerce websites like Qoo10 and the fast growing Bargain Queen (bq.sg) provide shoppers with a wider selection at cheaper prices.

Source: Company’s Website

There are also other beneficiaries with the growth of e-commerce. Online payment companies such as Visa (V), Mastercard (MA), Paypal (PYPL), etc. are benefiting from e-commerce transactions. Like what Peter Lynch had predicted, when an industry grows rapidly, it attracts competition. Apple and Alibaba recently ventured into this industry with the introduction of Apple Pay and Alipay.

Online retailing is not the only e-commerce activity. According to Merriam-Webster, e-commerce is defined as the activities that relate to the buying and selling of goods and services over the Internet. We can consider online bank products, such as online banking and brokerage services as forms of e-commerce. Recently we observed the rise of fintech and crowdfunding companies. Abroad, we saw rich valuations when peer-to-peer lending company, Lending Club (LC) went IPO. Locally, Moolah Sense, New Union and Fundhive are making a buzz providing attractive returns for their investors, as their business models bridge funding and investment needs between SMEs and investors.

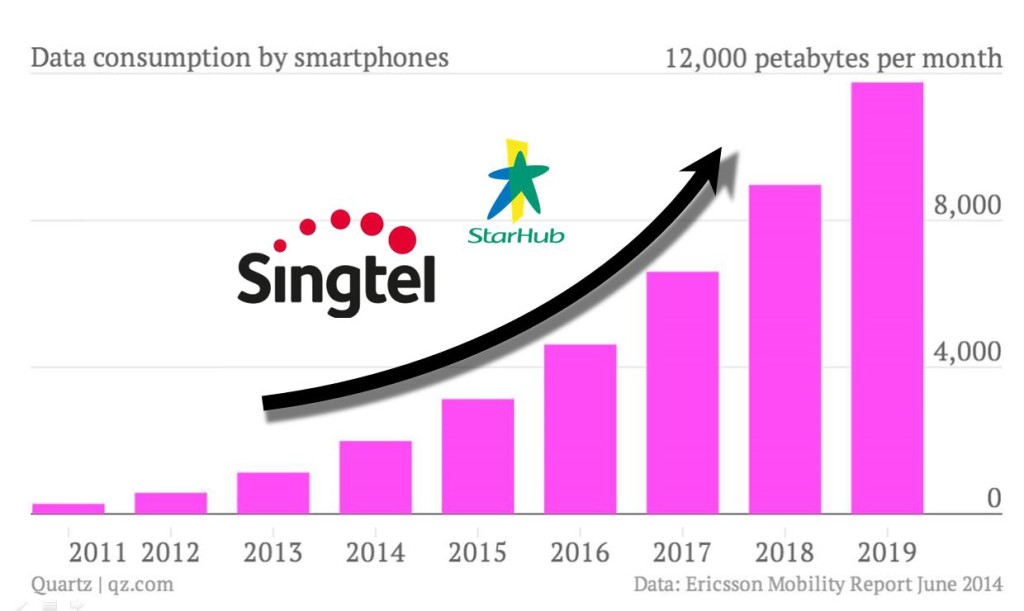

Other groups of beneficiaries which support the explosion of e-commerce include telco operators and logistics companies. As social and consumer behaviors shift online, consumption of data increases. Telco operators such as Singtel (Z74.SI) and Starhub (CC3.SI) are in position to capitalise on the rise in data consumption. How logistics companies such as Singpost (S08.SI) and SATS (S58.SI) benefits from this? When an item is purchased online, the item has to be delivered. SATS handles a large volume of freights via air into Singapore and Singpost leverages on its distribution channels to deliver the goods to the buyer.

Although we are cannot predict the future, we can foresee a more connected and digital world, where the Internet seamlessly connects to the offline world and e-commerce continues to grow rapidly. With proper analysis and understanding, you can ride this growth and maximize your investment dollars.

We will be releasing our next series shortly…stay tuned by signing up for our newsletter here!

3 Comments

Thanks for the post. Looking forward to find out what are the other 2 industries…

I think it is one thing to tell which industry will do well over the long term, but identifying which company in that industry will become winner is an entirely different matter. Automobile become disruptive (to horse) in the early 20th century, there are close to 2000 automobile companies in US alone back then, now just 3, what are the chance of telling which one will survive? Other disruptive industries back in their own time from radio, television, airline etc all the way to internet companies before dotcom bubble, there were thousands of them, many did make the founders super wealthy, but not their shareholders.

Hi Ricky, thank you for your sharing. You are absolutely right. It is challenging to pick the winner in any industry, much less a fast paced growing one. That’s why track record, predictable earnings, good balance sheet and management with integrity are ways to mitigate the risk while riding the upside. The other way would be like what Peter Lynch does, pick the biggest winner in the deadest industry. We will be posting the industries, and afterwards, pick the companies which we think are well poised within the industry. We do appreciate your feedback and looking forward for more! Thanks.