Book To Read: Rich Dad’s Cashflow Quadrant

In our previous book review, we shared Peter Lynch’s One Up on Wall Street.

Today, we decided to review one of the most influential personal finance book of all time.

Rich Dad’s Cashflow Quadrant, by Robert Kiyosaki, is about defining how you generate money through self-awareness and action. It examines four different ways of thinking about money, their advantages and disadvantages, and the path you can take to reach financial freedom.

Robert Kiyosaki is a businessman and author of the Rich Dad Poor Dad series. He is a veteran and a native of Hawaii. Kiyosaki pursued business and investing from a very young age. By the lessons he learned from his father (Poor Dad) and the mentorship of his friend’s father (Rich Dad), Robert began to learn how to manage risk and make money work for him.

Rich Dad, Poor Dad

“Rich Dad, Poor Dad“, the first book by Kiyosaki, provides much background for Cashflow Quadrant (book 2). It demonstrates that being rich begins with a state of mind. Robert stresses recognizing the difference between assets and liabilities, then acting to increase the former and limit the latter. He establishes assets as anything that puts money in your pocket and liabilities as anything that takes money out. He challenges the basic belief of your home as an asset. Kiyosaki states that it is liabilities like the house you bought to live in, goods that depreciate in value (doodads), consumer loans and credit cards are what keep a person from attaining real wealth.

He maintains that passive income from businesses, real estate, dividends and other assets are what provide the ability to increase cashflow and excel financially. A proponent of financial IQ, he suggests that people can avoid the “rat race” of living paycheck-to-paycheck and hopping from one job to the next by managing cash flow. Rich Dad Poor Dad offers lessons and ways of thinking that can result in money working for you rather than you working to pay bills and expenses.

Cashflow Quadrant

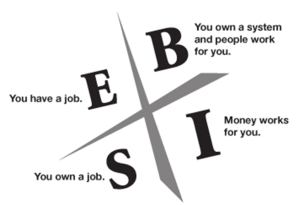

Kiyosaki’s second installment reaches deeper into the minds of four types of people and the ways they generate income. He introduces the Cashflow Quadrant, which organizes people into these categories:

1. E (employees): E’s work for companies or the government. They often seek a steady job with a benefits package. They avoid risk because they are led by fear. The most important thing to an E is security. Questions an E would ask are: “I’m looking for a safe secure job with good pay and excellent benefits.”

2. S (self-employed): They want to be their own boss or “do their own thing.” They are very independent when it comes to money. Doctors, lawyers, accountants and artists tend to fall into this category. S’s want to determine how much they make. The most important thing to an S is independence. Things an S would say are: “If you want something done right, do it yourself”

3. B (business owners): B’s like to surround themselves with smart successful people and hire them. They like to delegate. They have mastered technical business skills like marketing, sales, accounting and negotiation. A business owner’s most notable characteristic is leadership. Things a B would say are: “I’m looking for the best people to join my team”

4. I (investors): They are excited by risk because they know how to use it to their advantage. They have figured out how to make their money work for them. I’s are educated in investing and act on intelligence. Questions an I would ask are: “What’s my return on Investment?”

It’s a state of being.

Kiyosaki says the Cashflow Quadrant is more about being than doing. It’s about recognizing where you fall in the four categories, then deciding if that’s where you want to stay. Are you motivated by financial security like E’s and S’s? Or do you desire financial freedom, like B’s and I’s? If you are the type of person who avoids risks, you most likely reside in the E or S category. If you view risks as opportunities, then you may dwell in the B or I category. This book opens another perspective on how your see your job and financial goals. We strongly recommend anyone who seeks financial freedom to read the Cashflow Quadrant.

After reading the book, you can choose to stay comfortably in your quadrant, move to another or generate money in all four. It’s up to you.

Want to move to the right?

Kiyosaki says that the fastest and easiest way from the left side to the right side is by increasing your financial intelligence. When you reach the right side, you’ll realize the benefits of having other people or money work for you. As a business owner or an investor, you will enjoy the passive income earned from your business or investments.

Forbes estimates that 8 out of 10 businesses fail within the first 18 months.

There are risks in doing businesses. Companies fail because of poor market research, lack of funding, poor planning and execution at every possible stages of the business, etc. On top of pouring your hard-earned money into the business, it also requires your invaluable time to nurture the business. If you do not have the time, passion and money, starting a business might not be the way for you to achieve financial freedom.

Investing is one of the way to go too!

Cashflow Quadrant unpacks the idea that being rich begins with the state of mind and that the path to financial independence can be realized by anyone who yearns to gain financial literacy and learn about investing.

Investing isn’t difficult and can be a reality for anyone. No matter where you fall in the Cashflow Quadrant, you can change the way you think about money and begin to have it work for you.

We have shared on the virtues of investing in our previous blog posts.

- Why you should invest

- Why you should invest [Part 2]

- Why you should start investing, even as an employee

If you are interested to get the books, they are available at: Rich Dad, Poor Dad |Rich Dad’s CASHFLOW Quadrant: Rich Dad’s Guide to Financial Freedom

So are you ready to take a bigger step to find a formula that can consistently pick out the best companies to invest in and make you a LOT of money in the stock market? If you are, then this might be the answer you have been looking for. Experts have used this same exact formula to create 7-figure results in a single stock portfolio – in just two years. Find out what this formula is right here. (Just to be transparent: this is an affiliate links. So if you decide to purchase the program through this link, We’ll receive a small commission. The price for you remains exactly the same. So if you purchased it in the end, we thank you very much!)

![Why should you invest [Part 2] everything else but 360x240 - Why should you invest [Part 2]](http://www.bytesizedinvestments.com/wp-content/uploads/2015/06/everything-else-but-360x240.png)