How does CPF Contributions work

This blog post is used to augment one of our previous blog as we did a comparison on how your CPF SA could be doubled if you could afford to contribute an additional $7,000 as CPF cash top up into your CPF SA.

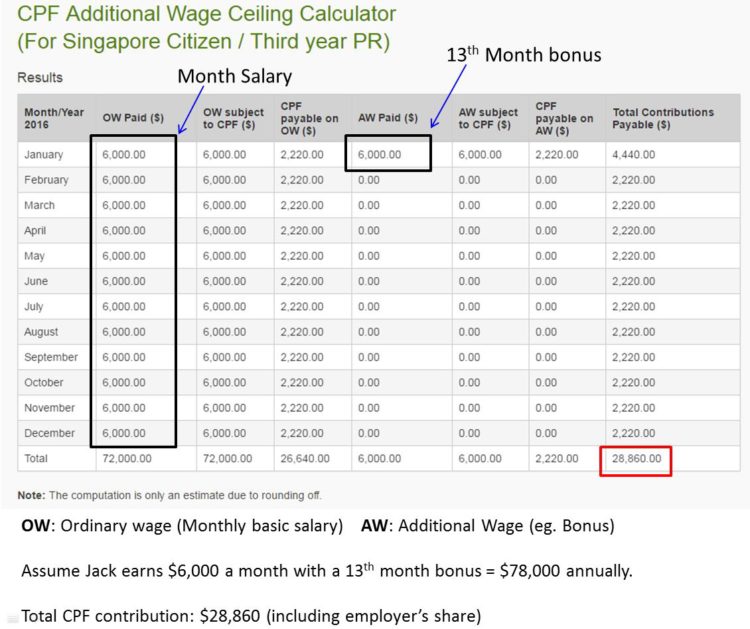

Here, we use Jack, our 28-year-old example, to depict the CPF and CPF SA contributions.

As you can see from the table above, in the black box is Jack’s salary for twelve months. At the bottom of the table, is Jack’s total income based on his “basic” annual salary of $72,000, and on the right, denoted in the smaller black box, was his 13th month bonus of $6,000, adding to a total annual income of $78,000. Inputting these details onto one of CPF’s calculators, we arrive with Jack’s total CPF contribution of $28,860 (boxed in red).

CPF SA Contributions

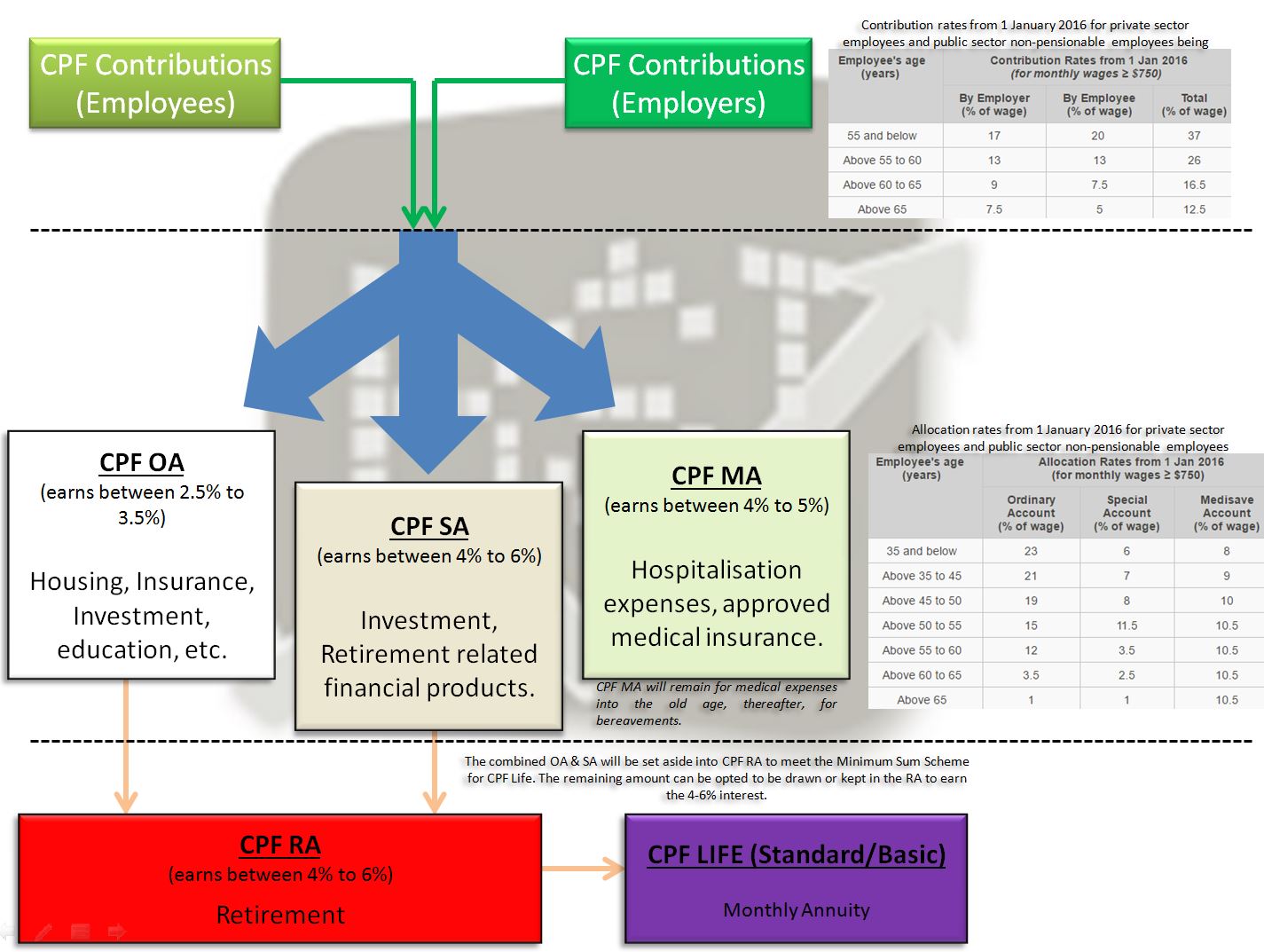

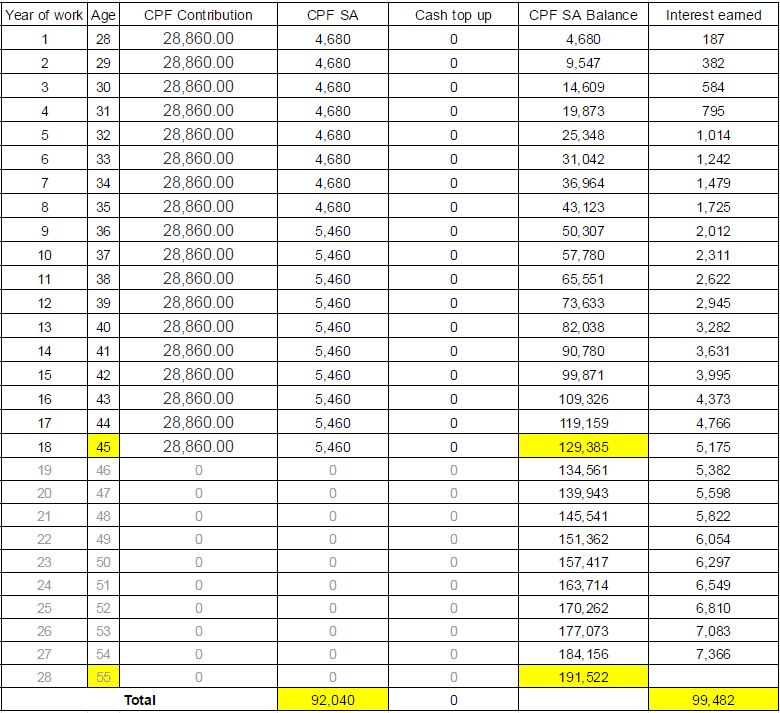

Recall the diagram above, for an employee 35 and below, 6% of his wage CPF contributions would be allocated into his CPF SA. Thus 6% of Jack’s $78,000 CPF contribution would result in about $4,680 1,732 being allocated into the CPF SA.

Between the age of 36 to 45, 7% of the $78,000 contribution would be allocated to Jack’s CPF SA, which is approximately $5,460. Hence you will see the CPF SA contribution as follows.

The rest of the columns in the table above would be explained deeper in our other blog post.

We hope you enjoyed this bite-sized posts, do sign up for our newsletters or like our Facebook page.

2 Comments

Hi there,

I’ve got a question regarding the calculation of the special account CPF contribution share.

Total contribution in the above example is $28,860 which consists of 37% share. 6% of that shouldn’t it be $4680?

$1,732 seems pretty low for annual contribution..

Hi Trey,

Thank you for pointing out the error. We took 6% of CPF contributions instead of 6% contribution from wages into CPF SA . We have duly corrected our error.

Cheers

Byte-Sized Investments