How insider trading can be used as a powerful indicator to help you make sound investment decisions

The act of management using their own money to purchase shares from the open market is called insider trading.

Insider Trading

Insider trading can be both legal or illegal. The rule behind this is whether a trade was made with unfair advantage/knowledge.

A trade is illegal if the management, or a friend of the management, makes a trade with information that has not been made public. People who commit illegal trading will be convicted and pay severe penalties. Here’s a news report of a insider trading case in Singapore. For the combined profit of $4.7 million the culprits made in 2009, they were fined $11.7 million in 2015!

Insider trading is allowed once the information has been released to the public. The traders, be it management or friends of managment, no longer has the unfair knowledge advantage over other investors. MAS mandates interested parties, top management, etc. to declare their transactions. In this way, MAS can monitor and govern insider trading.

Take advantage of Insider Trading

There could be multiple reasons when management used COMPANY’s cash to conduct share buybacks. It could range from making good capital allocation to supporting the share price.

With a leveled playing field, when law abiding management used their OWN hard-earned money to purchase shares of their company, what does it tells you?

Management probably believes that the company is worth buying at that price!

This is ONE powerful indicator that you can use to monitor your watchlist.

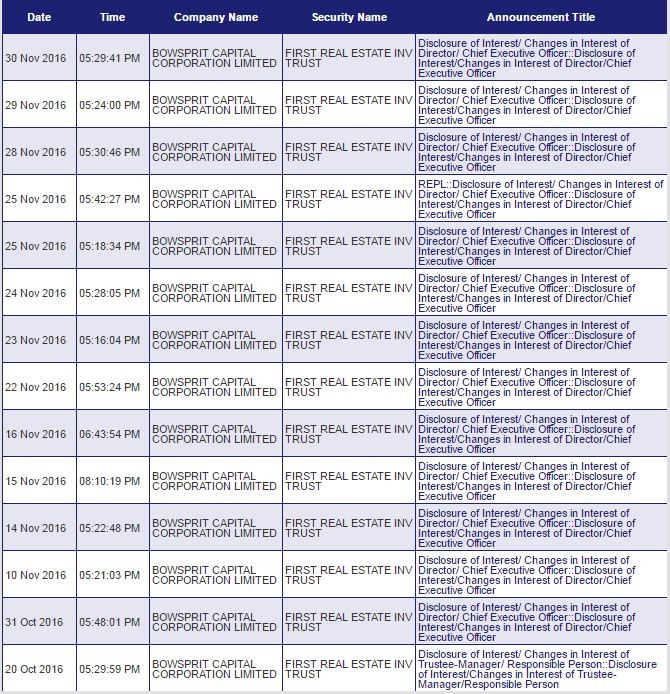

Take a look at this…

In the month of Nov 2016, the CEO of First REIT purchased a total of 641,000 shares from the open market at an average share price of $1.279, costing him more than $800,000.

$800,000 of his OWN hard-earned money!

Purchase supporting share price?

Let’s take a look at the possibility of the CEO conducting share purchases of his own company in order to support the share price.

If one was supporting the share price, in a market where everyone else was dumping, his purchase should constitute the majority of the daily transacted volume. There’s no exact numbers or ratio but if he was supporting the share price…well, at least it should be more than half the daily transacted volume right?

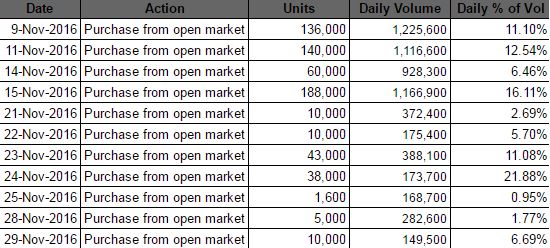

The table above showed the dates when First REIT’s CEO repurchased his shares (first column on the left), amount of shares bought (third column from the left), the transacted volume for the day (second column from right) and the percentage of CEO’s purchase to the total daily volume (first column from right).

As you can see, out of 11 days, there was only 1 day (24 Nov) where insider’s share buyback volume was more than 20% of the daily transacted volume. There were 4 days the percentage was above 10% whilst the rest of the days, the amount insiders repurchased were less than 10%.

If you look deeper, on 24 Nov 16, the day with the highest percentage of share purchased, the number of shares purchased was only 38,000. This was less than half the amount he bought on 9, 11, and 15 Nov.

Based on the volumes, we do not feel those purchase warrants the support of share price. Furthermore, if I were to support share price, I would rather use the company’s (shareholder’s) cash to support the share price, not my own $800,000 of hard-earned money.

In fact, this was not the first time we observed our CEO using his own money to purchase shares of his own company. Last year, we observed that our CEO purchased more than 997,000 shares from the open market from June to September 2015, at an average share price of $1.34.

Right valuation is necessary

Of course, one cannot blindly follow the footsteps of insiders to world’s end. You must first ensure the company is one of great fundamentals, and thereafter, derive its valuation. When the stock price is below your valuation, coupled with insiders buying, these indicators should provide you a strong buying conviction.

We hope you enjoyed this bite-sized posts, do sign up for our newsletters or like our Facebook page.

Note: Byte Sized Investments has vested stakes in First REIT.