ST Engineering reports higher profits in 2Q2016

Byte Sized News Release: ST Engineering reports higher profits in 2Q2016

Key highlights

- Commercial sales constituted 65% or $1.1 billion of 2Q2016 revenue

- Order book of $11.6 billion at end June 2016, of which about $2.5 billion is expected to be delivered in the remaining months of 2016

- Cash and cash equivalents including funds under management totalled $1.3 billion

- Economic value added for first half of 2016 was $152.4 million (1H2015: $173.4 million)

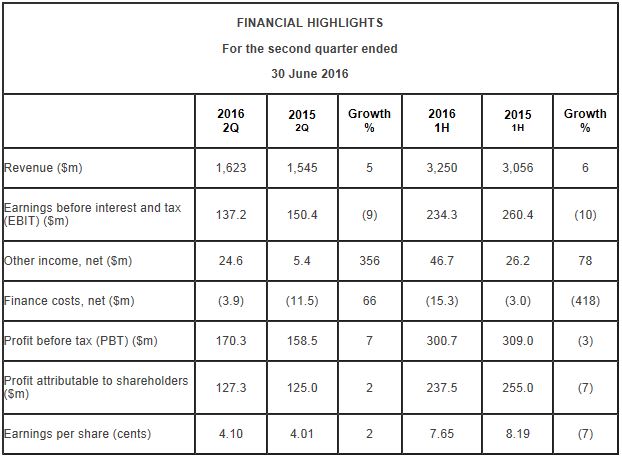

ST Engineering’s Quarter Results: 2Q2016

On 12 Aug 16, ST Engineering announced their second quarter financial results. Revenue increased $1.62 billion, compared to $1.55 billion in the same period last year. Profit before tax (PBT) was $170.3 million, up 7% from $158.5 million posted in the same period last year. Year-on-year profit attributable to shareholders (Net profit) was comparable at $127.3 million.

ST Engineering’s Six Months Results: 1H2016

On a half-yearly basis (1H2016), the Group posted higher revenue of $3.25 billion, up 6% compared to $3.06 billion a year ago. PBT was comparable at $300.7 million and Net Profit was $237.5 million, 7% lower compared to $255 million a year ago.

ST Engineering’s Interim Dividend

The interim ordinary dividend of 5.0 cents per ordinary share had been paid out to shareholders on 30 August 2016.

ST Engineering opines that as the global economic outlook remains challenging with industry headwinds facing the marine business, slow-down in the China economy, and negative business sentiment that is prevalent in Europe and other parts of the world, barring unforeseen circumstances, the Group expects FY2016 Revenue to be higher, but PBT to be lower compared to FY2015.

Having said that, the share price of ST Engineering had been surging.

This knowledge could have made you a 25% return in 12 months.

What knowledge would that be?

It is share buyback. Previously, we explained that share buybacks could be seen as good indicators. This is because when the company uses repurchase their own shares, they perceived that their company as undervalued. (see articles here and here)

Of course, before you blindly go out to chase every stock with a share buyback, you need to discern whether is this a company with good fundamentals and capable management, and at what price. Another case you could argue is that the company could be destroying value by employing shareholder’s cash to support the stock price. However, the intentions of the repurchase are never obvious. Unless you work in the company and have access to management’s decisions, your guess is always as good as ours.

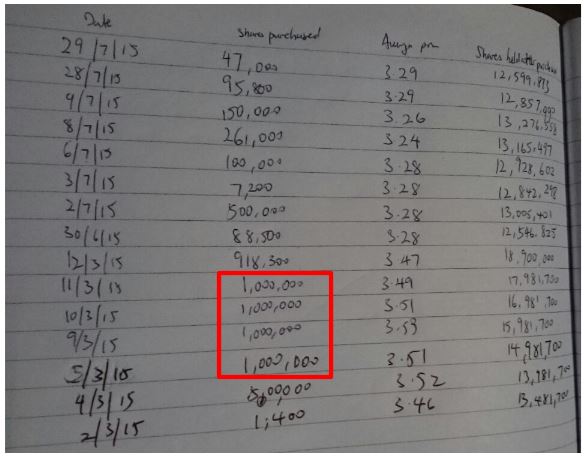

Below, you noticed that ST Engineering had been buying back their shares from Mar to Aug 15, at prices between $3.60 to $2.80. The number of share repurchases in Mar 15 were up to a million a day!

Source: Company’s website

Some of the questions you may want to ask yourself when you observe share buybacks:

- Are the company’s fundamentals good?

- Is the share buyback accretive?

- Is the company trying to support the share price?

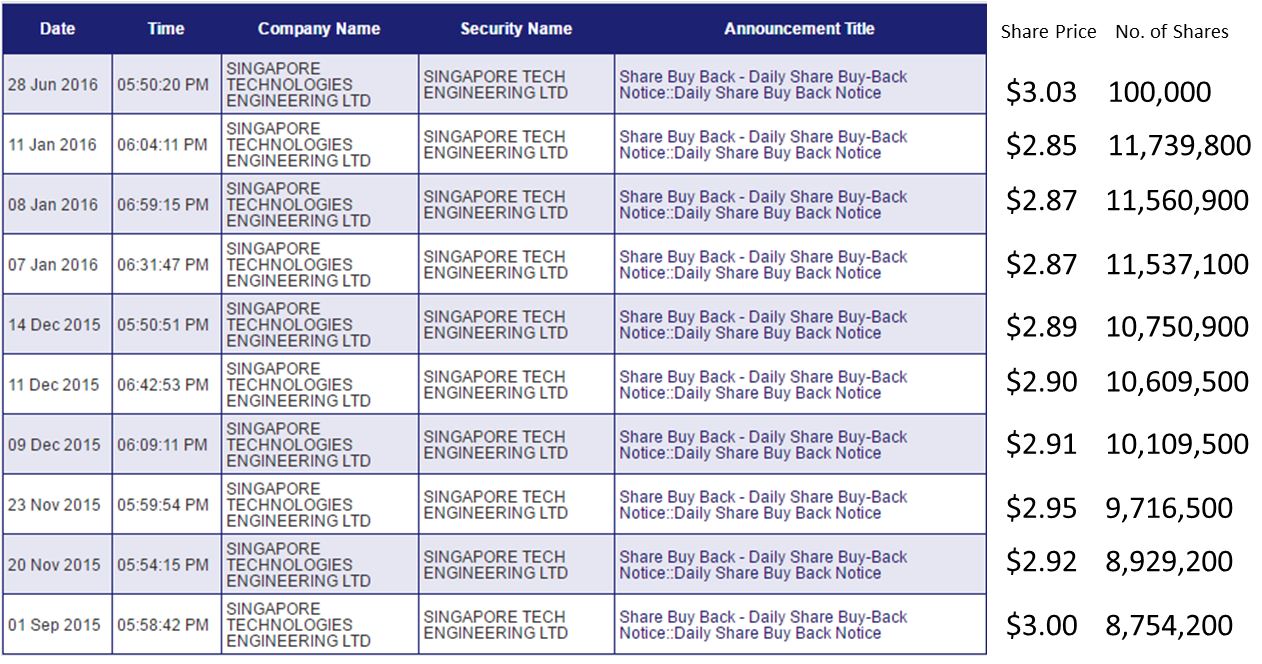

We also recorded their recent share buyback activities. Did you manage to spot the trend?

Noticed that ST Engineering were more aggressive with their buybacks when the price was lower than when its higher.

Although ST Engineering 1H16 profit was slightly down compared to the same time last year, you could have been sitting on a comfortable profit of 25% if you had capitalized on share buyback when the stock was trading at around $2.80. Since the release of that article end Aug last year, ST Engineering has also issued a total of $0.15 in dividends. Its current share price is $3.41 (6 Sep 16).

At the same time, ST Engineering has also outperformed the index by about 15%.

We did not manage to enter at the lowest point, but by applying the knowledge, we made a handsome 20.7% in 12 months.

One would say, lock the profits in:

“A bird in hand is worth two in the bush.”

That is true if we were trading. But as investors, we usually do not realize our profits for such short horizons, even after holding it for a year! Such actions are those of a trader (there’s nothing wrong with trading. Trading can also be VERY profitable. It is however not a style that we at BSI are suited). Who knows, in a couple more days, the price could plunge again. But we are okay with this temporal lose if the company’s fundamentals remained intact. This is because we believe in the long-term earning power of the company.

People invariably feel better after the market gains 600 points and stocks are overvalued, and worse after it drops 600 points and the bargains abound. – Peter Lynch, One up on Wall Street.

We aim to provide value to our readers by providing investment-related news and our analysis/views of the selected news.

To receive regular byte sized news, sign up for our newsletters or like our Facebook page.

Note: Byte Sized Investments has vested stakes in ST Engineering.

Disclaimer: Byte Sized Investments does not provide financial advice or stock tips, all information contained herein are the opinions and ideas of the authors. The information does not amount to financial, investment or any form of advice and is strictly for educational purposes only. You are advised to perform your own independent research or to contact a licensed professional before making any investment decisions