What would Vicom Ltd’s earnings be like in 2 years?

Byte Sized News Release: Vicom Ltd’s Q2 profit down 8.3% to S$6.07m

Vicom Ltd has recently released its 2nd quarter’s financial statement on 7 August 2017.

- Revenue was down to S$24.1 million (S$25.4 million in 2Q 2016), translating to a 5.2% decline.

- Net profit dropped 8.3% year-on-year to S$6.1 million. Its net profit margin was 25.2% compared to 26.1% last year.

- Earnings per share for 2Q 2017 was 6.85 Singapore cents, compared to 7.47 Singapore cents in 2Q 2016.

- As at 30 June 2017, Vicom has S$100.9 million in cash with no borrowings, decreasing slightly from S$105.7 million (with zero debt) from its 31 December 2016 balance sheet. Despite the slight decline in cash position, the firm’s balance sheet is very healthy.

- Cash flow from operations was at around S$6 million, with S$746,000 spent on capital expenditure. For this quarter, Vicom has S$5.2 million in free cash flow, a slight decrease from S$5.5 million in for 2Q 2016.

- Vicom’s dividend for this financial period is 13.12 Singapore cents (8 Singapore cents 2Q 2016) as it revised its payout ratio to 90% of Net Profit attributable to Shareholders from the previous policy of 50%.

Vicom 2Q 2017 Financial Results

| 2Q 2017 | 2Q 2016 | YoY % | |

| Revenue | $24.1 mil | $25.4 mil | -5.2% |

| Net Profit | $6.1 mil | $6.7 mil | -8.3% |

| Earnings per share | 6.85 cents | 7.47 cents | -8.3% |

| Free Cash Flow | $5.2 mil | $5.5 mil | -5.5% |

| Dividend per share | 13.12 cents | 8.00 cents | +64% |

The results has been in line with what we had expected. We had blogged a few times on why we think Vicom’s results may drop in the short term.

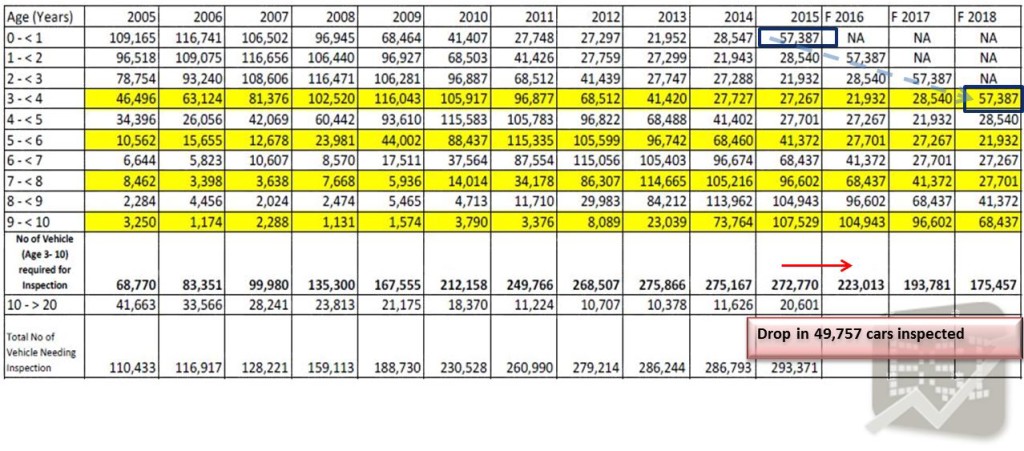

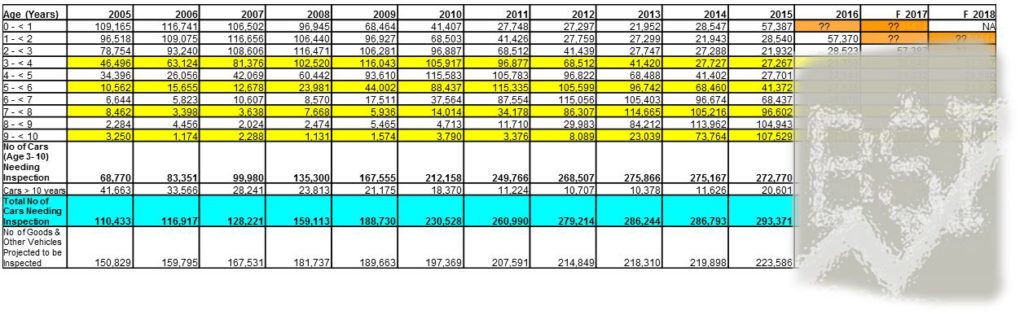

In those articles, we argued that Vicom Ltd’s business condition will remain challenging due to the cyclical nature of car registrations/de-registrations.

Vicom’s Inspection Numbers

We also plugged LTA’s car registration and de-registration figures to make sense of the impact.

So how will these information help us to value Vicom? There are information in Vicom’s past numbers that offers us a clearer glimpse of Vicom’s future.

Traditionally, Vicom do not disclose its segment reporting due to the competitive nature of their businesses. However, we managed to tinkle with publicly available information to help us peek into Vicom’s future earnings.

We will be releasing the information in our newsletters shortly so do sign up if you’d like to know them. If you have already signed up with us, sit back and wait for it to come into your mailbox. 🙂

Note: Byte Sized Investments has vested stakes in Vicom.

2 Comments

I wish to sign up for ur newsletter

Dear Augustine, you have been added on our mailing list! 🙂 Thank you.