Why did Vicom’s 2nd quarter’s net profit drop.

Byte Sized News Release: Vicom reported a 12.6% drop in net profit for 2Q16

On 10 Aug 16, Vicom Limited (SGX: V01) released its second-quarter earnings. The reporting period was for 1 April 2016 to 30 June 2016.

Revenue for the second quarter was $25.4 million, down 6.9% from the same quarter a year ago. Net profit attributable to shareholders also fell by 12.6% year-on-year to $6.6 million. Earnings per share was 7.47 cents in the reporting quarter, down 12.6% from the 8.55 cents recorded in the same quarter last year.

On a positive side, cash flow from operations came in at $6.5 million while capital expenditure (capex) was around $1.1 million. This provided Vicom with $5.5 million in free cash flow.

As of 30 June 2016, Vicom had $95.8 million in cash and equivalents and no debt. This is a decrease from the net cash balance of $100 million recorded at the end of last year.

The board of directors proposed an interim dividend of 8 cents per share for the second quarter of 2016, down from 8.75 cents per share (down 8.5%) paid out last year for the same period.

On the company’s outlook, Vicom opined that demand for vehicle testing services will continue to be impacted as more vehicles will be deregistered during the year. Demand for non-vehicle testing services is not expected to improve.

What caused such a decline in its net profit?

Vicom is currently hit on two major fronts. Its vehicle testing and inspection segment experiencing a downturn due to a high number of vehicle deregistration from 2015 onwards. I have previously written about it here.

Its non-vehicle testing and inspection segment, SETSCO, is also experiencing headwinds as the industries they serve are experiencing a continued slowdown, especially in the petrochemical, oil and gas sector.

However, due to the competitive nature of the industry, Vicom does not disclose segment reporting. Despite that, the information on its vehicle testing and inspection segment are readily available. Note that Vicom, being the leader in this segment, dominates the market with approximately 70% market share.

The numbers are showing: More cars de-registering than registering.

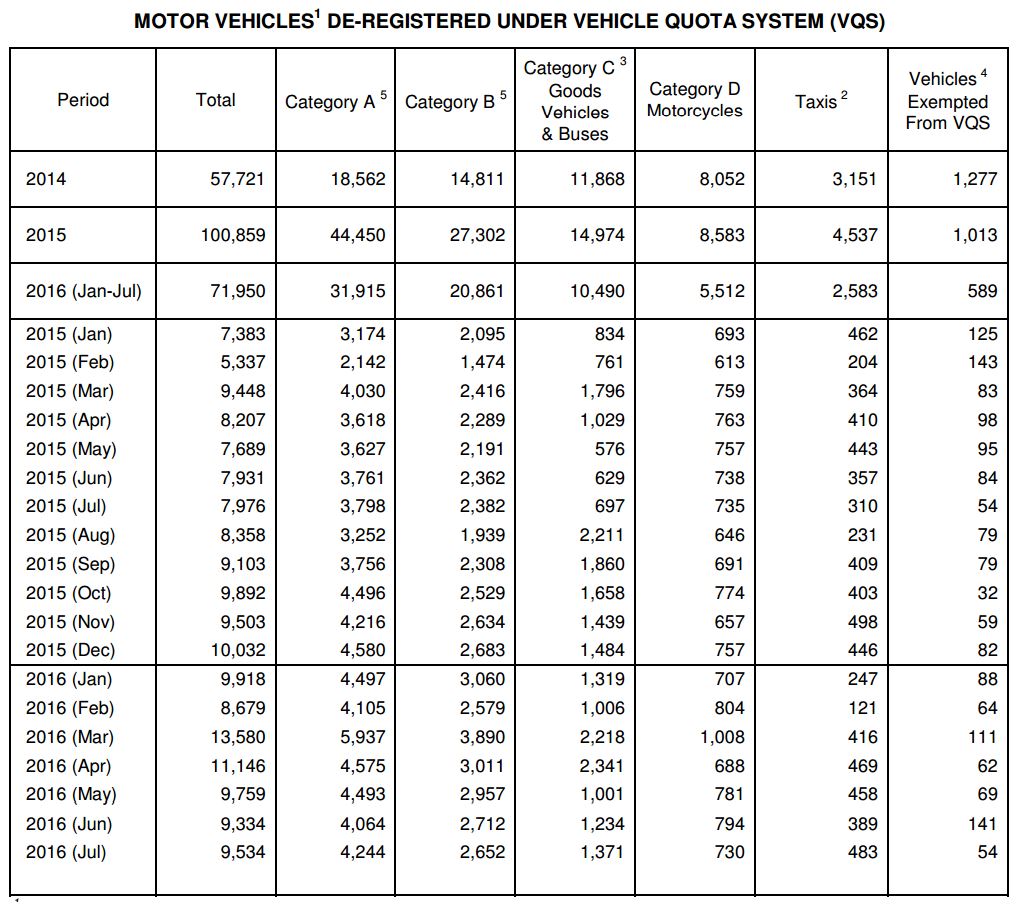

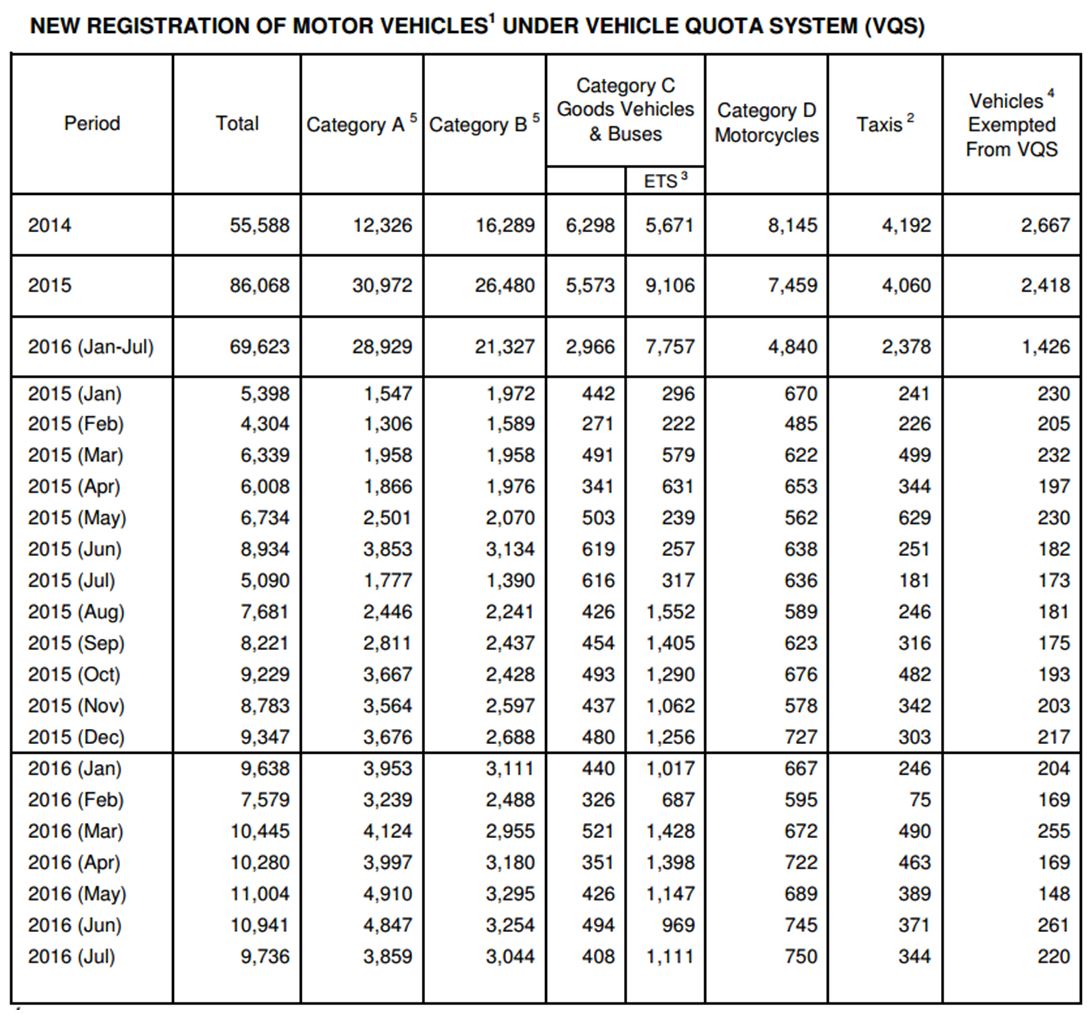

For the full year of 2015, 100,859 cars deregistered. For the six months in 2016, close to 70,000 cars were deregisterd. Noticed that the total deregistration for the first 6 months was 70% of the total number of vehicles deregistered last year? In fact, the deregistration of the vehicles was higher in each of the month this year than last.

What concerns Vicom in the next 5 – 10 years is whether the car population is going to increase. We all know that government aims to be a “car-lite” society, reducing cars and improving accessibility via public transport. But let’s take a closer look at the facts. How many cars are being registered?

Did you realise that from 2014, more cars deregistered then registered?

| Year | New Registrations | Vehicles De-registered |

| 2014 | 55, 588 | 57,721 |

| 2015 | 86,068 | 100,859 |

| 2016 (Jan – Jul) | 69,623 | 71,950 |

Well, an observant reader could highlight that what matters is the number of vehicles on the road, and how many of them are of “inspection” age.

Vehicle population to decline.

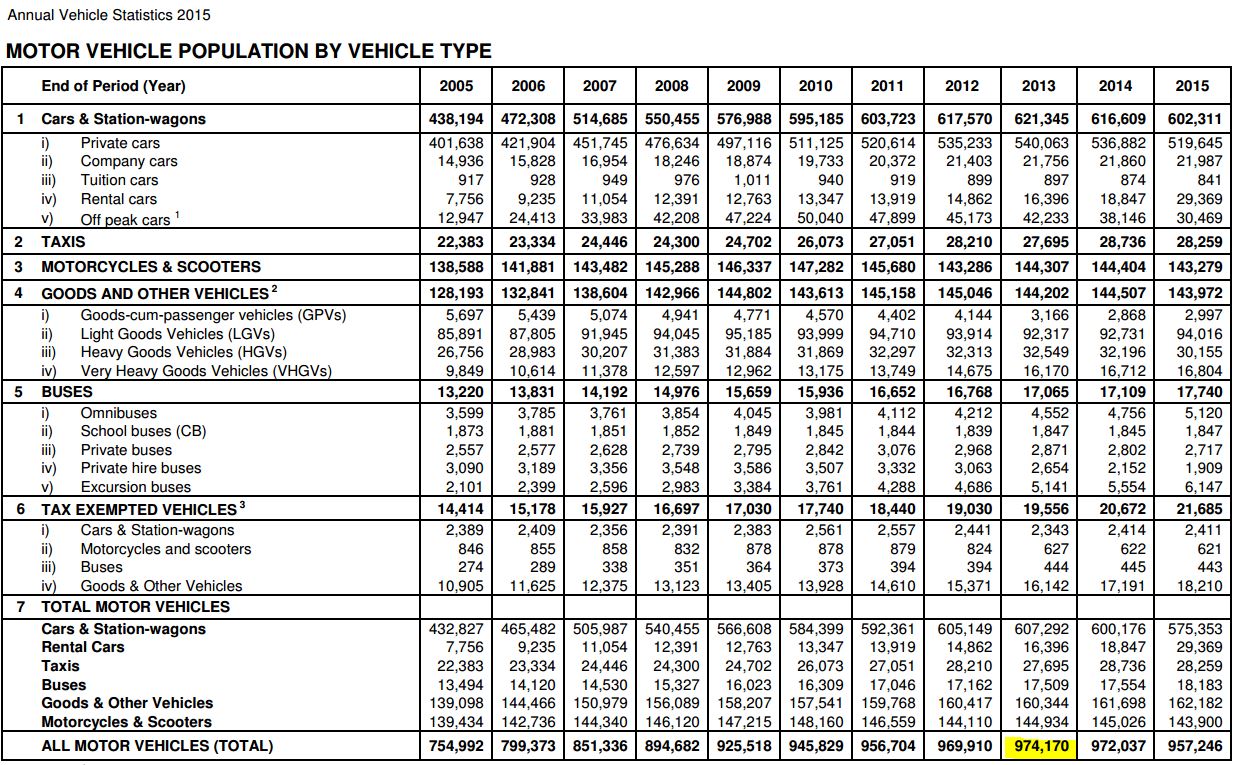

You noticed that the peak was in 2013; thereafter the vehicle population declined. The bulk of the inspection revenue comes from the inspection of cars and station wagon, due to its sheer size, and the fees.

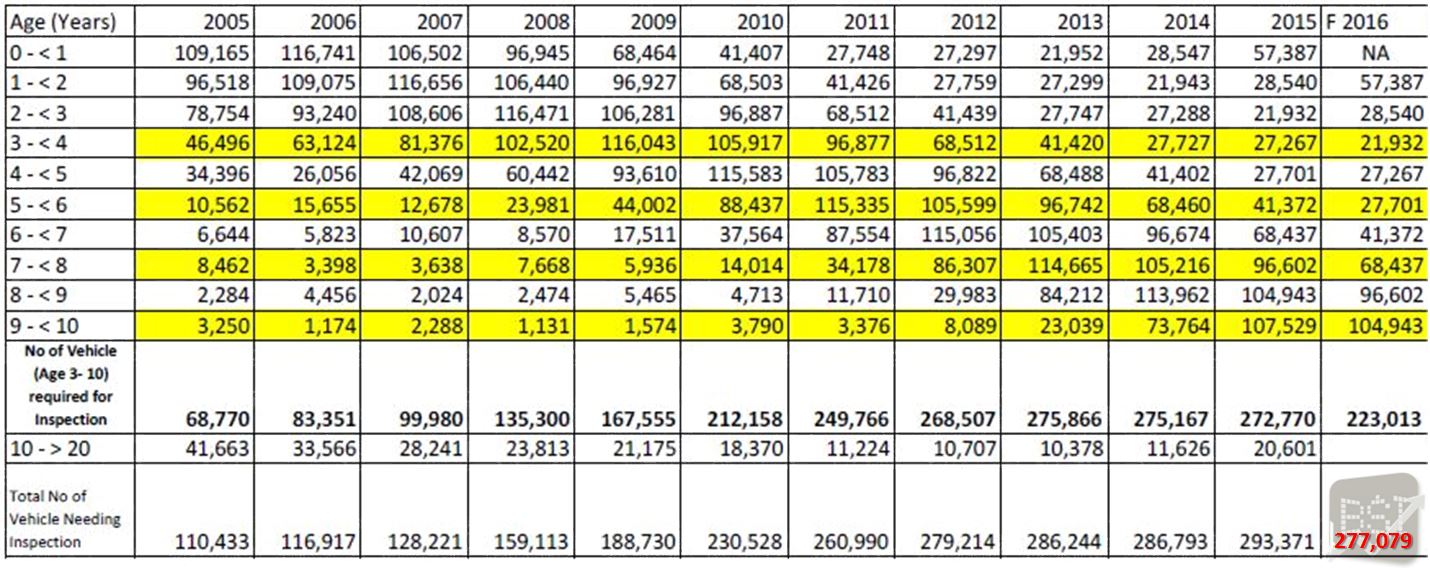

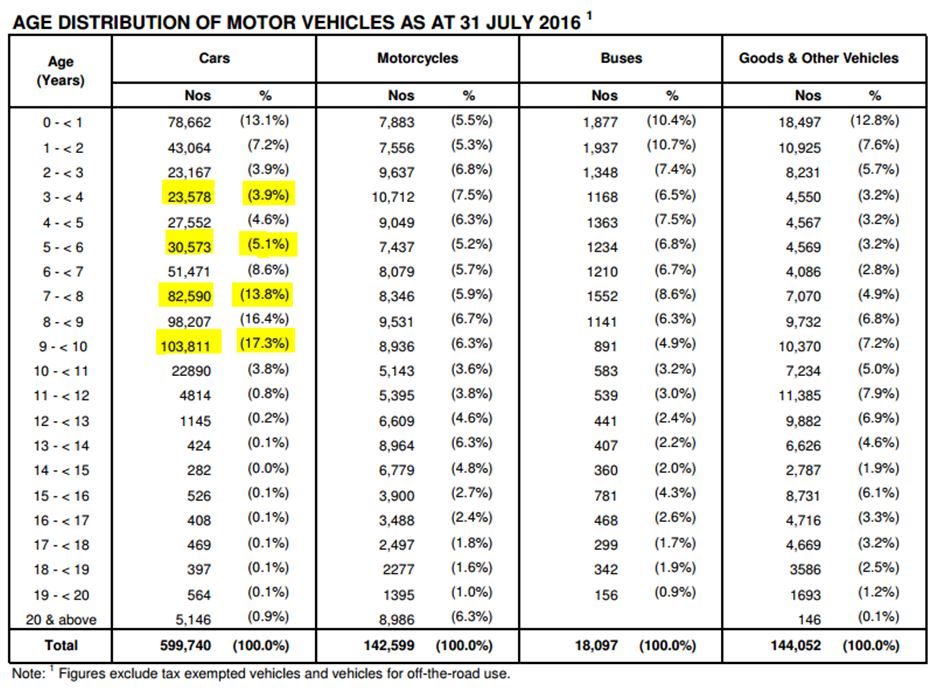

Taking LTA’s Jul 16 age distribution of motor vehicles, 46.2% of the 599,740 cars require inspection. This means that about 277,079 cars require inspection for the year of 2016. This results in a 5.5% drop in the total number of cars inspected, from the estimated 293,371 total cars inspected last year.

Conclusion: The macroeconomic view of Vicom is slightly gloomy, with headwinds from both the government’s car-lite policies (long-term) and the higher deregistration of vehicles compared to registration (short-term: 2-3 years). Hence a drop in net profit in the short term wouldn’t be a surprise. However, the business is cyclical, which means that it will pick up once the up cycle swings in. Vicom has a strong and honest management and they are exploring all means to improve shareholder’s returns. It is worth monitoring Vicom’s key data for the fundamental inflection point.

Previous posts:

- A deeper dive into Vicom’s fundamental.

- 5 interesting pointers to note for Vicom Limited 2015 Full Year Report.

If you like our post sign up for our newsletter NOW!

Please leave a comment on what you like to know on Vicom.

Note: Byte Sized Investments has vested stakes in Vicom.