First REIT: 1Q16 Financial Results

Byte Sized News Release: First REIT 1Q16 Financial Results

First REIT has released their 1Q 2016 financial results on 18 Apr 16.

The key highlights were as follows:

- First REIT once again, achieved record DPU of 2.11 Singapore cents compared to 2.06 Singapore cents of the same period a year ago.

- On 3 February 2016, First REIT announced that they were entering a joint acquisition with Lippo Malls Indonesia Retail Trust for Siloam Hospitals Yogyakarta (SHYG) and a retail mall, to which First REIT will acquire SHYG for a purchase consideration of S$40.82 million. This will add an additional S$3.85 million per annum of rental income.

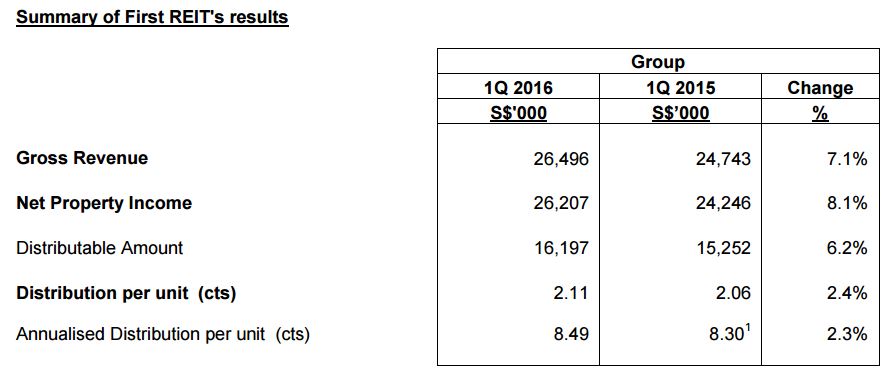

Gross revenue and net property income increased 7.1% and 8.1% respectively, from S$24.7 million to S$26.5 million and S$24.2 million to S$26.2 million (increased by S$2 million). This resulted in a 6.2% rise in distributable amount, from S$15.2 million to S$16.2 million (increased by S$1 million), translating to a DPU of 2.11 Singapore cents compared to 2.06 Singapore cents a year ago.

The growth was spurred by new acquisitions, in particular, the latest acquisition in December 2015, the Kupang Property, comprising Siloam Hospitals Kupang and Lippo Plaza Kupang, which added an initial base rent of S$3.84 million, payable quarterly in advance. This translate to an estimated contribution of S$0.96 million for 1Q16.

It was noted that First REIT will continue to look for yield-accretive acquisitions to maximize returns shareholders’ returns. They are backed by a strong sponsor, PT. Lippo Karawaci Tbk., which has a visible strong pipeline of 44 hospitals.

To receive regular bite-sized finance news, sign up on our blog or like us on Facebook.

Previous article on First REIT:

First REIT will be holding their AGM on 19 Apr 16, 9am, at Mandarin Ballroom III, Level 6, Main Tower, Mandarin Orchard Singapore, 333 Orchard Road, Singapore 238867.

Note: Byte Sized Investments has vested stakes in First REIT.