ARA posts 1Q16 net profit of S$19.4 million

Byte Sized News Release: ARA posts 1Q16 net profit of S$19.4 million

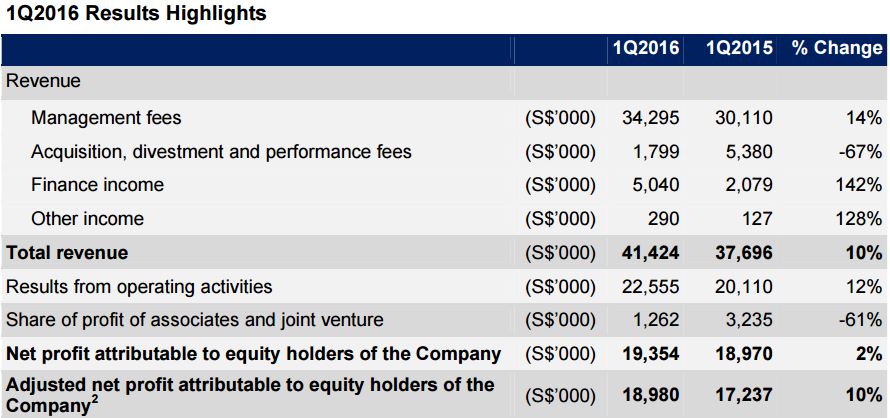

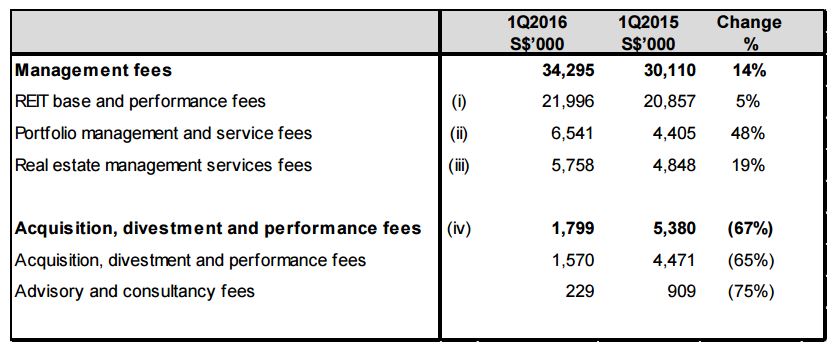

ARA Asset Management Limited (ARA) reported total revenue of S$41.4 million and net profit of S$19.4 million for the quarter ended 31 Mar 16, resulting in net profit margin of 46.8%, down from 50% for FY2015. Recurrent management fees for 1Q16 grew strongly by 14% to S$34.3 million, due to growth in REIT management fees, portfolio management and service fees as well as real estate management fees.

REIT management fees grew 5% year-on-year to S$22.0 million for 1Q16, mainly attributable to better asset performance from the existing properties after the successful asset enhancement initiatives (AEI) undertaken, resulted in higher property valuations. Suntec REIT’s acquisition of three floors of strata office space at Suntec Tower Two and Cache’s acquisition of three Australian properties in the last quarter of 2015 also contributed to the higher REIT management fees.

Portfolio management and service fees grew 48% year-on-year to S$6.5 million in 1Q16, mainly due to higher management fees from the ARA China Investment Partners, LLC following the acquisition of two commercial properties in China in Sep and Dec 15, in addition to the launch of the ARA Harmony Fund III and the ARA Harmony Fund V in August and Dec 15 respectively.

Real estate management fees grew 19% year-on-year to S$5.8 million in 1Q2016, mainly due to higher property management fees received by the Group.

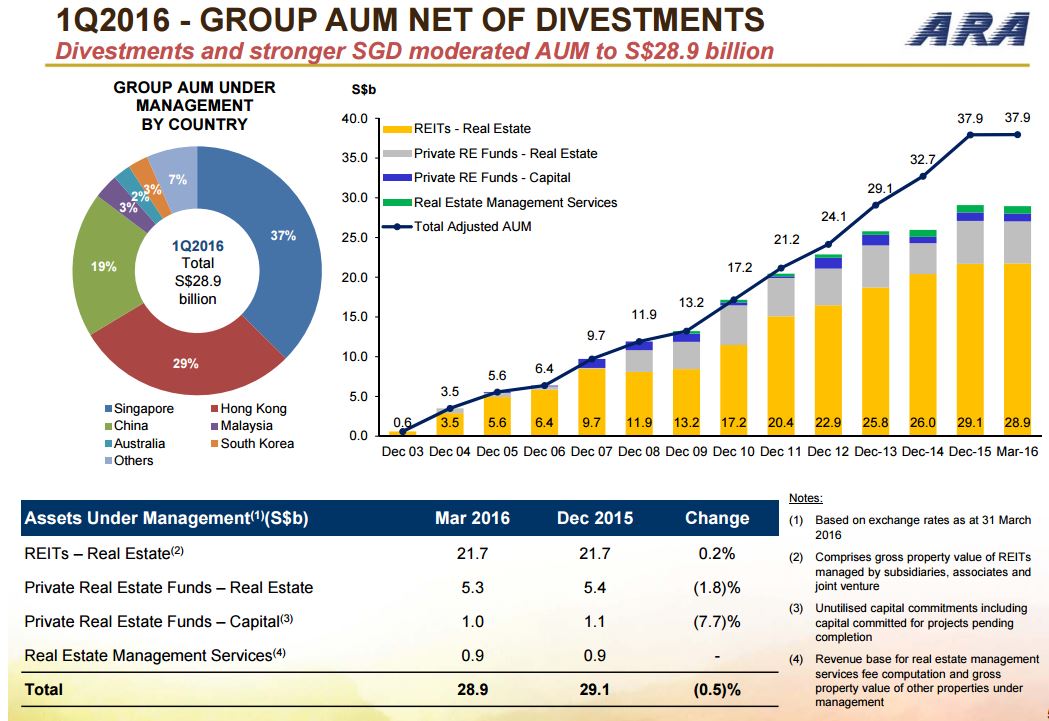

As at 31 Mar 16, the Group’s total AUM decreased to S$28.9 billion (approximately US$21.5 billion) from S$29.1 billion (Dec 15), moderated by a strengthened Singapore dollar against foreign currencies (in particular the US dollar) and the effect of divestments.

Source: Company’s website

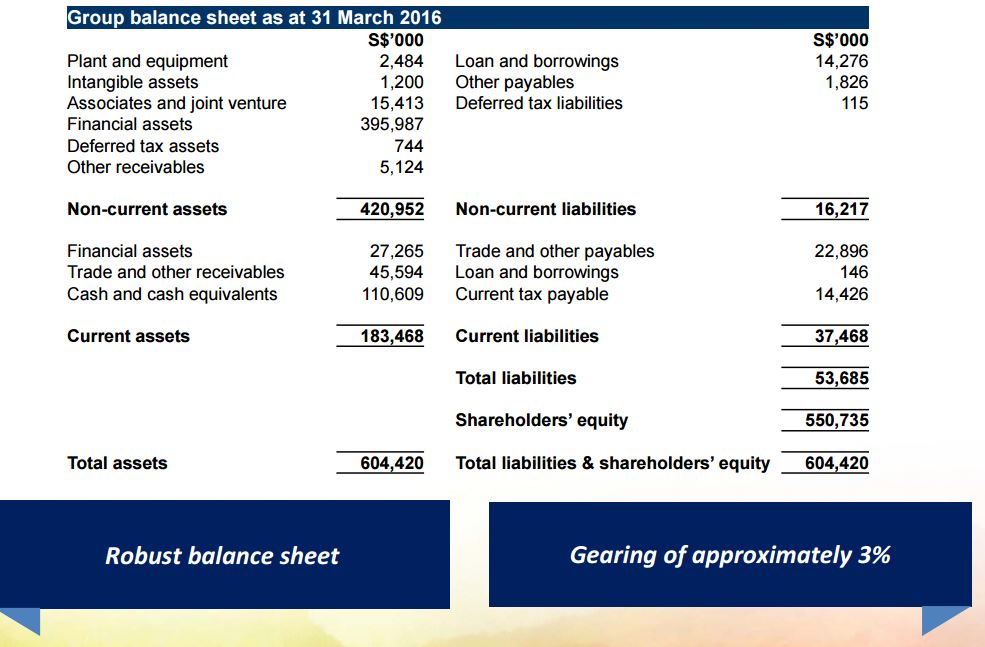

ARA has a strong and robust balance sheet with gearing ratio at 3%, current ratio at 4.9 and cash ratio at 4.2. This was mainly attributed by the rights issuance.

To receive regular bite-sized finance news, sign up on our blog or like us on Facebook.

Note: Byte Sized Investments has vested stakes in ARA