What does ARA Rights Issue means to you

ARA Asset Management Limited (ARA) announced on 11 Nov 15 a rights issuance (click here to find out more on rights issuance). It will issue a total of 152,127,196 shares based on 845,151,093 total outstanding shares. What it mean to shareholders is that for every 100 shares he owns, he is entitled to exercise his rights to purchase 18 shares at $1.

Before we dwell deeper, a quick introduction on ARA.

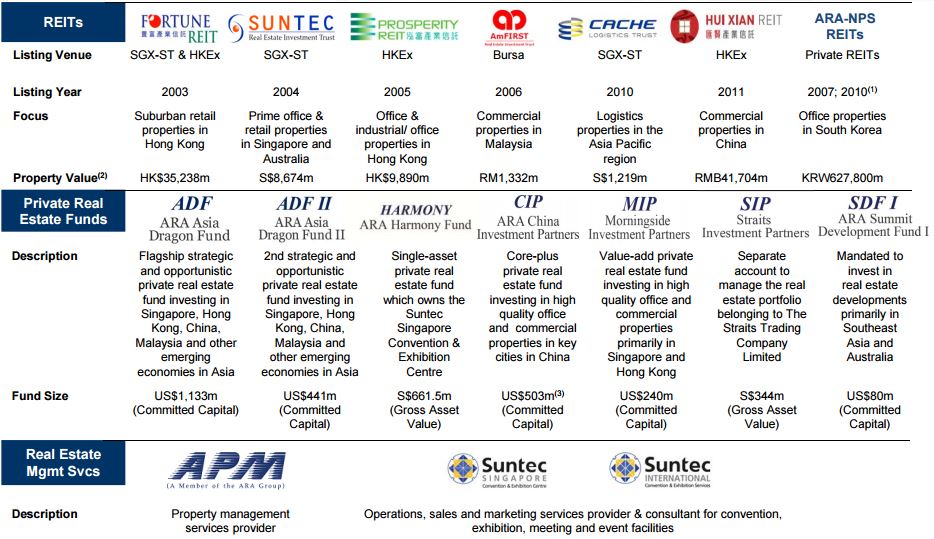

ARA is a manager of real estate investment trusts and real estate funds. It adopts an asset light model, earning management, acquisition and divestment fees through the management of REITs under its jurisdiction, and performance fees from its private real estate funds. The local and overseas commercial, retail and logistics REITs it manages include Suntec REIT, Fortune REIT, AmFIRST REIT, Cache Logistics REIT, etc. as shown in Figure 1. Its asset under management (AUM) as of 30 Sep 15 stands at S$28.8 billion. It has engaged Straits Trading Company (STC) and Cheung Kong (CK) as its strategic partners. As of 27 Nov 15, ARA has a market cap of S$1.197 billion.

So why is ARA offering a rights issue?

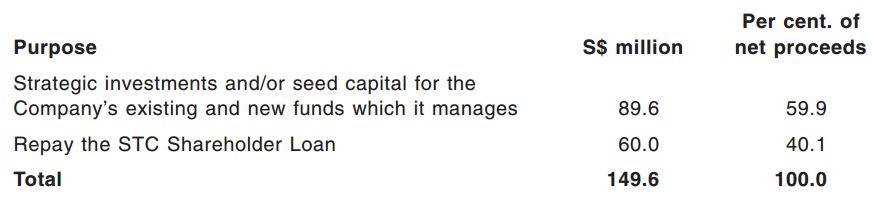

Based on the offer statement (page 48), the issuance will raise approximately S$152.1 million. After paying expenses from rights issuance of about S$2.5 million, the proceeds will be used for:

Pending deployment into strategic investments, proceeds will be deposited in the bank or used for other short term investments.

Why does ARA needs cash?

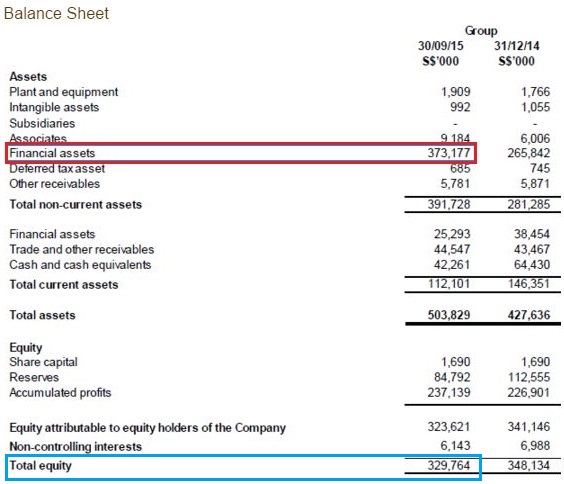

According to its latest quarterly statement, ARA has S$44 million in cash and cash equivalent (CCE), S$137 million of current and long-term debts. A year ago, it has S$64 million of CCE with a total debt of only S$34 million. Cash has gone down, while debt increased. ARA borrowed to increase their strategic stake in Suntec REIT. Digging deeper, it is revealed that ARA increased its stake in Suntec REIT by 173%, from 34.1 million shares in Sep 14 to 94.3 million (~4% of Suntec REIT total shares out) in Sep 15. Its strategic stake in AmFIRST and Cache Logistics REIT remained unchanged though. In total, its financial assets (including stakes in the abovementioned REITs) comes up to about S$370,000 million.

With total equity of about S$330,000 million, the financial assets are almost equivalent to its equity (See Figure 2)! ARA seems to be turning away from its asset light model!

Why did ARA increased its stake in Suntec REIT?

At a valuation of S$8.6 billion, Suntec REIT is ARA’s flagship product. Its next largest REIT is Fortune REIT, valued at HK$35 billion (S$6.4b). According to the offer, increase in stake reflects the Company’s alignment of interest with unitholders of Suntec REIT as well as its strong commitment towards managing and further growing Suntec REIT to continue delivering premium value. It could also be increasing its stake to guard its interest. But from what?

If you had followed our Facebook post, Fitch recently reported that Singapore REITs (SREITs) are at risks due to weaker economic fundamentals in 2016. We see that it could possibly mean SREITs being at risks of takeover, hostile or otherwise. An example of a recent SREITs takeover/buyout is Saizen REIT. With more than 80% of Suntec REIT’s shares out in the public, ARA increase stake could be seen as guarding its interest from possible takeovers.

Similarly, with an enhancement of S$90 million in its war-chest, ARA is now armed with a seed capital of S$150 million. ARA can aggressively pursue acquisition in 2016 as they try to boost earnings growth by capitalising on lower asset valuations.

When it comes to shares liquidity, ARA is on the other spectrum, with only 35% in public hands. Although rights issuance does not increase the liquidity, it does increase the amount of shares out. Perhaps, in due time, the increase in shares out may improve liquidity.

With the increase in shares out, there is one important point to note. It seems as if ARA aims to maintain its annual dividend per share at S$0.05. It has maintain at this level for the past 5 years, allowing predictable and sustainable income for shareholders. It increased its dividend to shareholder by issuing bonus shares in 2010, 2011 and 2013, when its profit could sustain such increases.

By increasing the shares out through rights issuance by almost 20%, ARA will increase its total dividend payout by 20%, should it stick to its dividend policy of S$0.05/share. If past years profits are not replicated, there might be a chance that its dividend per share could decrease.

At S$1.195, ARA is currently priced 15 times its earnings. If we were to less one-off items, ARA has a recurrent PE of 17. To purchase the rights at S$1, it would translate to 12 times PE or 14 times recurrent earnings.

Similarly, with S$0.05 of dividend, it translate to about 4.2% dividend yield. At the issue price of $1, it would translate to 5% dividend yield.

ARA well poised after rights issue

Armed with an enhanced war-chest, which could easily multiply into a large committed capital due to its well networked strategic partners, we believe that the rights issuance will enable ARA to be well poised to capitalise on opportunities in the coming year.

Note: Byte Sized Investments has vested stakes in ARA. John Lim’s last share repurchase was in Mar 13 at $1.60.

If you like our post sign up for our free newsletter NOW!