First REIT acquisition of Hospital & Mall in Buton for S$28.5 million.

Byte Sized News: First REIT Strengthens Portfolio With Acquisition In Strategically-Located Port City On Buton Island, Indonesia

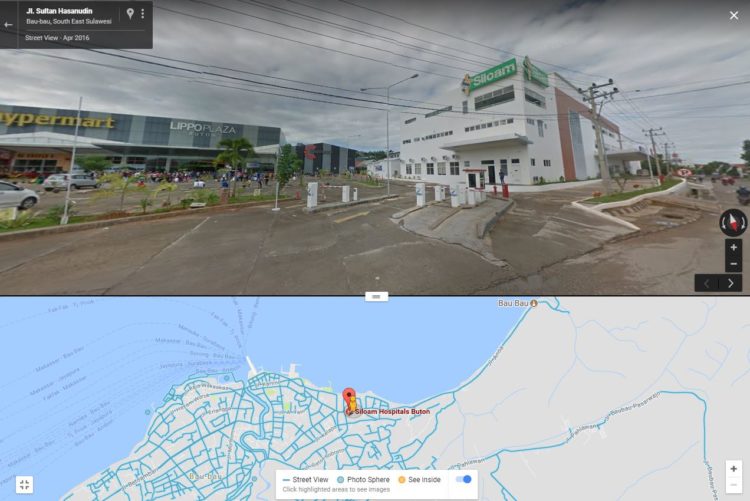

On 20 July 2017, the manager of First REIT announced that First REIT would be acquiring Siloam Hospitals Buton (SHBN) and a mall, Lippo Plaza Buton (LPB) for a combined S$28.5 million (subjected to shareholders’ approval). The acquisition price is 2.4% lower based on the higher of two independent valuations. The total acquisition costs, including acquisition fees payable to manager, professional and other fees, would come up to S$29.44 million. In the picture above, you can see the hospital on the right and the mall on the left.

Where is it?

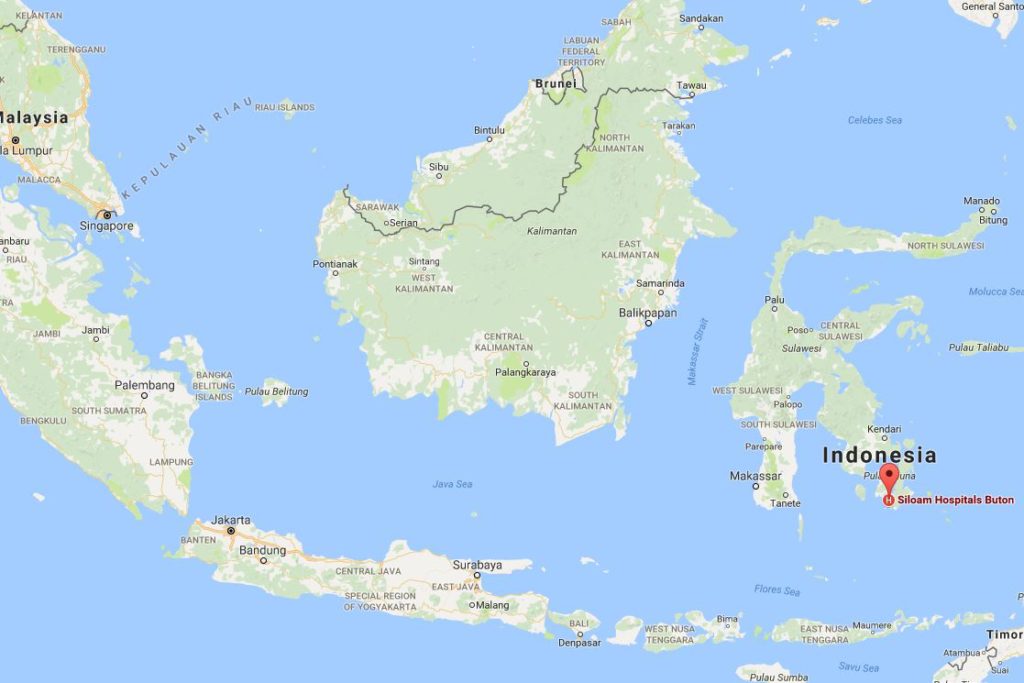

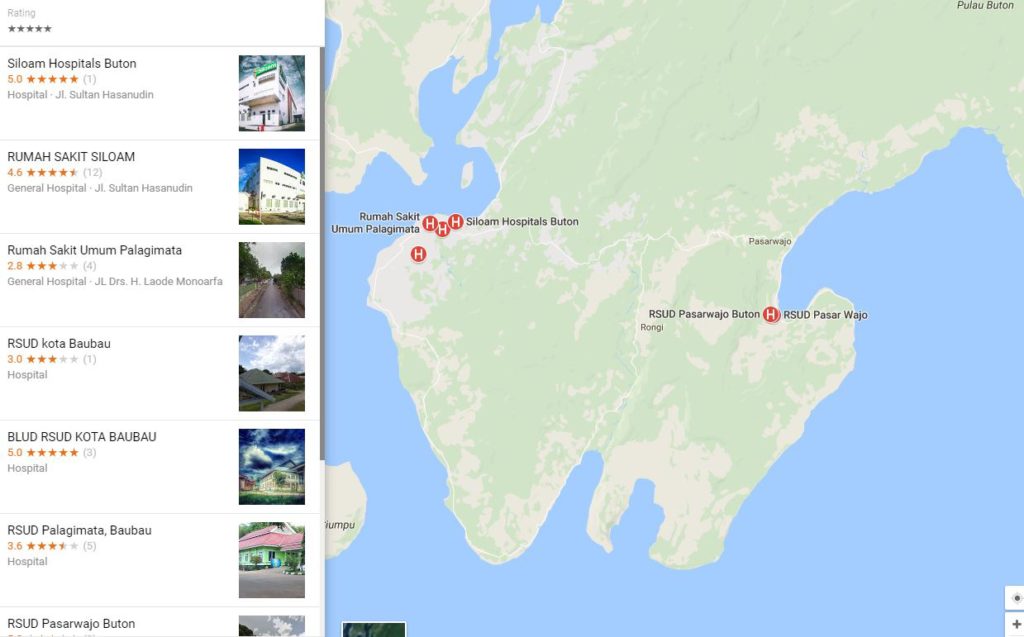

The property is situated in the City of Bau Bau, the main city of Pulau Buton, located on the southeast peninsula of Sulawesi. Based on Indonesia’s 2014 Central Bureau of Statistics, Bau Bau has a population of 151, 484. In the map below, you will notice that there are more than 3 medical centres in the city of Bau Bau and 4 in the south of Pulau Buton.

SHBN, which commenced operations in April 2016, has 160 beds and ancillary healthcare-related space including, operating theatres and equipment for medical services such as radiology, haemodialysis, physiotherapy and neurology.

A nearby competitor’s medical facilities, RSU Bau Bau (referred as RSUD Kota Bau Bau in map above), also provide inpatient/outpatient services, operating room, ICU, X-ray and ultrasound services.

Siloam Hospital Buton & Lippo Mall Plaza acquisition increases First REIT’s NPI by S$2.84 million.

The acquisition of the hospital and the mall provides First REIT with S$2.84 million of rental income. This would increase its FY2016’s NPI of S$105.84 million by 2.6%. Note that a S$2.85 million in rental income on a S$28.5 million price acquisition price provides a 10% rental yield!

Note that First REIT provided a Pro Forma that estimates the acquisition increasing DPU by S$0.03/share (0.7% increase), this was based on the 6 months financial results ending June 17.

Similar to previous acquisitions, the triple net lease term for SHBN of 15 years provides First REIT with income clarity for the duration of the lease. LPB is also under a 15 year lease. Both lease has an option for another 15 years renewal after the first 15 years.

Also, SHBN rent comprises of an initial base rent and a variable rent. Both rental components has inbuilt rental escalation, determined by Singapore’s Consumer Price Index and the hospital’s gross operating revenue growth respectively.

TRIPLE NET LEASE – ON TOP OF HAVING THE TENANT (SILOAM) BEAR THE COSTS OF LEASING, TENANT ALSO HAVE TO PAY THE NET AMOUNT FOR THREE TYPES OF COSTS, INCLUDING NET REAL ESTATE TAXES ON THE LEASED ASSET, NET BUILDING INSURANCE AND NET COMMON AREA MAINTENANCE. THIS TYPE OF LEASE CAN ALSO BE REFERRED TO AS A NET-NET-NET (NNN) LEASE.

Acquisition increases First REIT’s AUM to S$1.3 billion.

This acquisition would increase First REIT’s AUM from S$1.27 billion to S$1.30 billion, a 2.4% increase. The total gross floor area also increases by 7%. The weighted average lease to expiry was increased by 3.3% and the weighted average age of properties became lower, decreasing from 10.1 years to 9.5 years.

How will this acquisition be funded?

The acquisition would be entirely funded in cash, financed via a combination of its internal cash and drawdown from First REIT’s committed debt facilities.

We also note that the acquisition fee was S$285,000, payable in units to the REIT Manager, Bowsprit Capital Corporation Limited. This is in line with the industry norms where asset management charges a 1% fee for asset acquisition or divestment. The acquisition also comes with another fee: S$650,000, considered as “professional and other fees and expenses”. These fees add up to $935,000, 3.25% of the total acquisition costs. A quick check with recent acquisitions of Suntec REIT & CapitaCommercial Trust shows that such fees are also a norm.

Byte Sized Takeaway

The acquisition generally improves First REIT’s NPI and DPU and should result in an increase in dividends per share.

If you like to receive notifications on our future posts, like our Facebook page or sign up for our newsletter!

Note: Byte Sized Investments has vested stakes in First REIT.

References:

- First REIT’s announcement of SHBN & LPB’s acquisition

- Population of Bau Bau

- Rumah Sakit Umum Bau Bau Information

- Suntec Acquisition of Southgate Complex

- CapitaCommercial Trust Acquisition of CapitaGreen

If you are into investing and like to know what the gurus think of the market right now, here’s one event coming up that YOU SHOULDN’T MISS: InvestX Congress. It’s an event for retail investors like you and me to gather to learn what’s working NOW in the investment world… it’s not about theory; everything’s “Been there, Done that”. Don’t hesitate, click here to get your tickets NOW!

1 Comment

The fact is that, their rental incomes are in SGD, so any currency movement will not impact FIRST reit