MTR Corp’s First Competitive Advantage

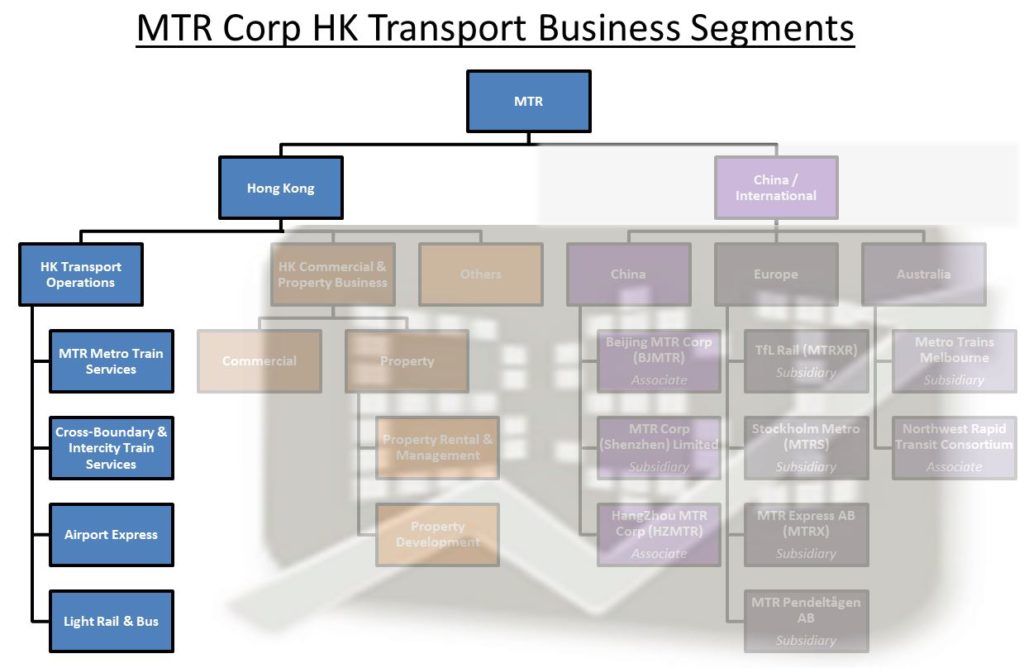

In our previous blog post, we shared that MTR Corp is the world’s most profitable metro/railway operator in the world and spoke about the revenue and recurrent business profit growth. We also shared broadly on its business segments, mainly Hong Kong’s Transport Operations, Hong Kong’s Property and its International Operations. Today let us explore more of its Hong Kong’s transport operations.

MTR’s Hong Kong Transport – 4 Business Segments

MTR Corp was established in 1975 by the Hong Kong (HK) government as a government-owned statutory corporation to build and operate the mass rapid transit system. The company was listed in 2000 with 75% ownership retained by the government. It was responsible for the operations of Hong Kong’s urban mass transit railway system with 10 heavy rail lines, a light rail system and feeder bus services. The HK transport operations have 4 business segments, (1) domestic Metro Train, (2) Cross-boundary and Inter-city train, (3) Airport Express and (4) Light rail and Bus (see Figure 1 above).

Domestic Metro Train Services

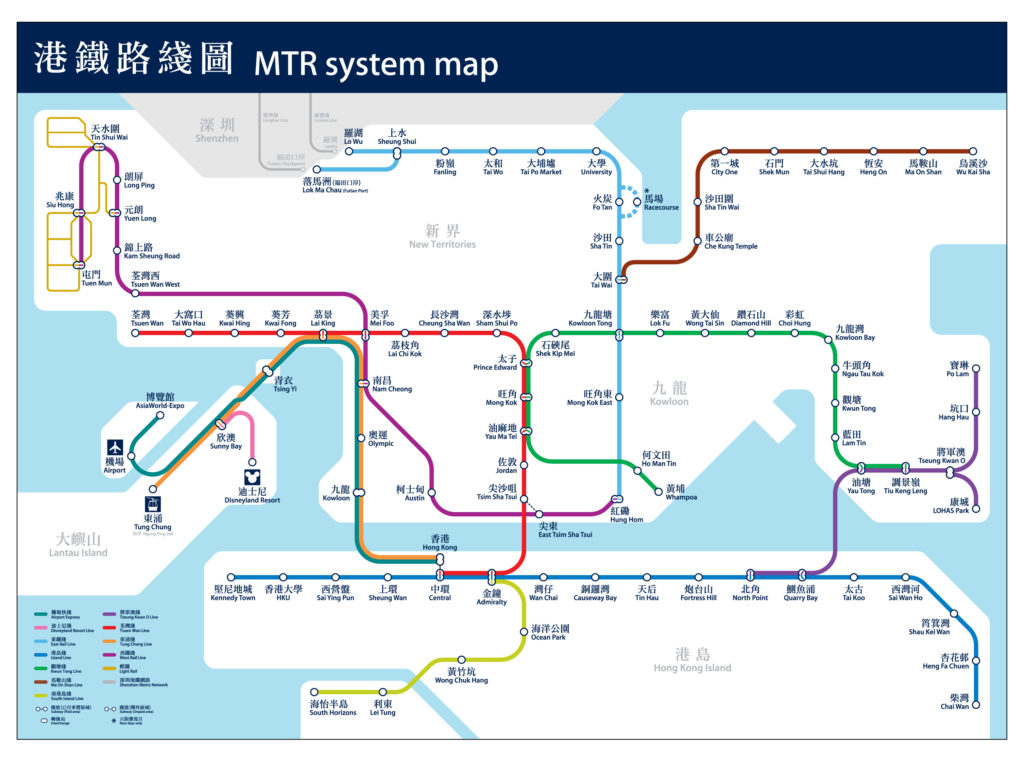

MTR’s domestic railway network covers 93 stations on 10 heavy rail lines, (1) Disney Resort, (2) East Rail, (3) Island, (4) Kwun Tung, (5) Ma On Shan, (6) South Island, (7) Tseung Kwan O, (8) Tsuen Wan, (9) Tung Chung and (10) West Rail line. These lines connect HK’s 4 main territories (Hong Kong Island, Kowloon Peninsula, New Territories and Lantau Island; wordings in grey) together. You can refer to Figure 2 below for MTR’s operating network.

Source: Company’s website

Cross-boundary and Inter-city Train Services

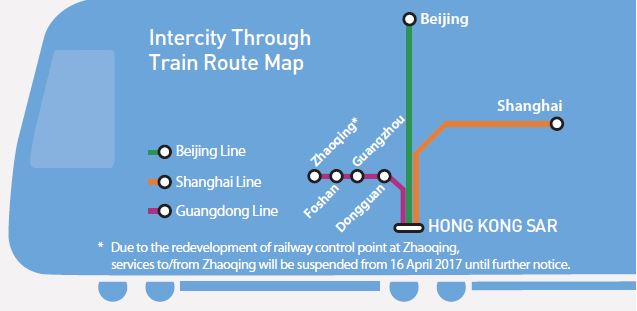

MTR also operates 3 separate rail lines that connect Hong Kong to Beijing, Shanghai and Guangdong through its inter-city train (Intercity Through Train, 港铁城际直通车). For Guangdong line, there is a total of 3 stations after departing from Hong Kong: Dongguan, Guangzhou, Foshan. Figure 3 below shows the Intercity Through-Train connection from HK to the 3 cities. Currently, it is also building its first High-Speed Rail that connects Hong Kong to Guangzhou and Shenzhen.

Source: MTR Annual Report 2016

Airport Express Services

MTR provides the fastest link from Hong Kong’s city centre to its International Airport on Chek Lap Kok, Lantau Island. The 35.3km journey between the airport and the city takes about 24 minutes. The line also offers a 2 minutes ride from Airport station to AsiaWorld-Expo, one of the two major convention and exhibition facilities in Hong Kong. The Airport Express Line is represented by the teal line in Figure 2 above.

Light Rail and Bus Services

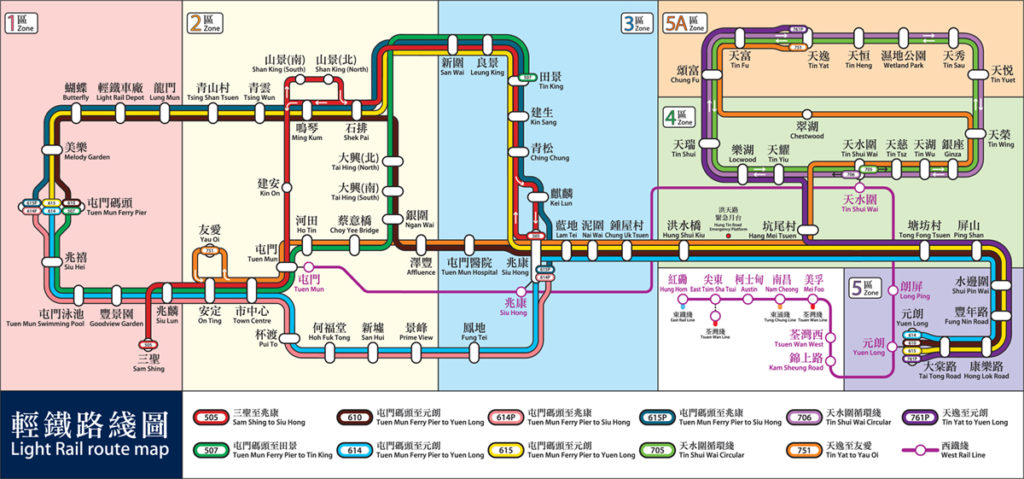

Light Rail network consists of 68 stops, operating in the Northwest part of New Territories. It increases the connectivity of the West Rail Line. In addition, a feeder bus service is provided to connect the estate to designated MTR stations. The Light Rail Line is shown as the yellow line in Figure 2 above. The route map of the Light Rail Line with its station is elaborated in Figure 4 below.

Source: Company’s website

Now you have understood the various transport operations that MTR does in Hong Kong…Did you know that 90% of the daily journeys commuted in Hong Kong are by public transport?

It is the highest utilisation in the world. Do you know why?

Hong Kong’s challenging terrain compels the government to encourage public rail transport

Hong Kong can be categorised into 4 geographical regions: Hong Kong Island, Kowloon, New Territories and Lantau Island. Noticed that in the google terrain map below (Figure 5), hills and mountains dominate majority of Hong Kong’s land area, as displayed in green. Generally, it is much more expensive to urbanize hilly areas, due to engineering and accessibility challenges as compared to flat, low lying areas, such as Kowloon, northwest of New Territories, north of Hong Kong Island (circled in red).

Source: Google Map

Hong Kong has a population of about 7.3 million in a total area of 1,104 square km. However, Hong Kong has only about 450 square km of developable land due to its hilly and mountainous terrain. The residential areas situate along the northern coast of Hong Kong Island, Kowloon Peninsula, Sha Tin and Tai Po and northwest of New Territories. These residential areas are shown in the darker shades of grey in Figure 6 below. However, the majority of the jobs are found in the Central Business District (CBD), in Kowloon and Hong Kong Island. This leads to the need for the populace to commute from the residential area (red arrows) in the north to the CBD (ovals) as denoted by cyan arrows as shown in Figure 7 below.

Source: LSE Cities

Source: Edited from Hong Kong Planning Department

With its unique landform, numerous islands, isthmuses, coastal indentations and mountains, Hong Kong’s landscape creates many bottlenecks and choke points. With only just 15% of the households owning a private vehicle, there are already about 347 licensed vehicles for every kilometre of road in Hong Kong. Its topography makes it challenging to expand its road capacity. For road-based transport, this often translates to extreme peak hour traffic congestions. Therefore, Hong Kong government was compelled to develop a public transport-oriented network system to reduce congestion at choke points. This results in Hong Kong having one of the highest number of public transport users in the world, with 90% of the daily journeys commuted by public transport, setting the stage for MTR’s competitive advantage.

Government encourage the use of rail, as it is a cost efficient way of mass-transport

Metro and Bus dominate the public transport usage, holding almost 80% of the market share. Of the 80%, MTR captured about 48% of the commuters who use public transport. From 2006 to 2015, daily ridership for train almost doubled while daily ridership for buses largely remained flat in the same period.

In Warren Buffett’s 2010 letters to his shareholder,

“Both of us (Buffett & Munger) are enthusiastic about BNSF’s future because railroads have major cost and environmental advantages over trucking, their main competitor. Last year BNSF moved each ton of freight it carried a record 500 miles on a single gallon of diesel fuel. That’s three times more fuel-efficient than trucking is, which means our railroad owns an important advantage in operating costs. Concurrently, our country gains because of reduced greenhouse emissions and a much smaller need for imported oil. When traffic travels by rail, society benefits.”

By economy of scale, the government understands that transporting people on the rail is much more cost efficient than compared to buses. Thus, the increasing proportion of trips made by rail is in line with the government’s policy of expanding its rail system. Much like the spoke and hub model, the government designed the public transport system to have the metro railway serves as the backbone of the public transport system while the other modes of public transport serve as supplementary roles to get the people to their last mile destinations. Since the government encouraged the use of rail as the primary means of mass public transport, with MTR being the sole rail operator in Hong Kong, this becomes MTR’s competitive advantage.

MTR’s Fare Price

MTR shares its fare-pricing model openly, known as the Fare Adjustment Mechanism (FAM). This method is also practiced in some countries such as Singapore, Bangkok, etc. to adjust fare pricing. This pricing mechanism was designed to reflect Hong Kong’s economic conditions, make public transport affordable, and generate enough revenue to support its long term operations. It adjusts fares based on the following factors:

- Composite Consumer Price Index (CCPI)

- Wage Index

- Productivity Factors (pegged by HK transport revenue and expenses)

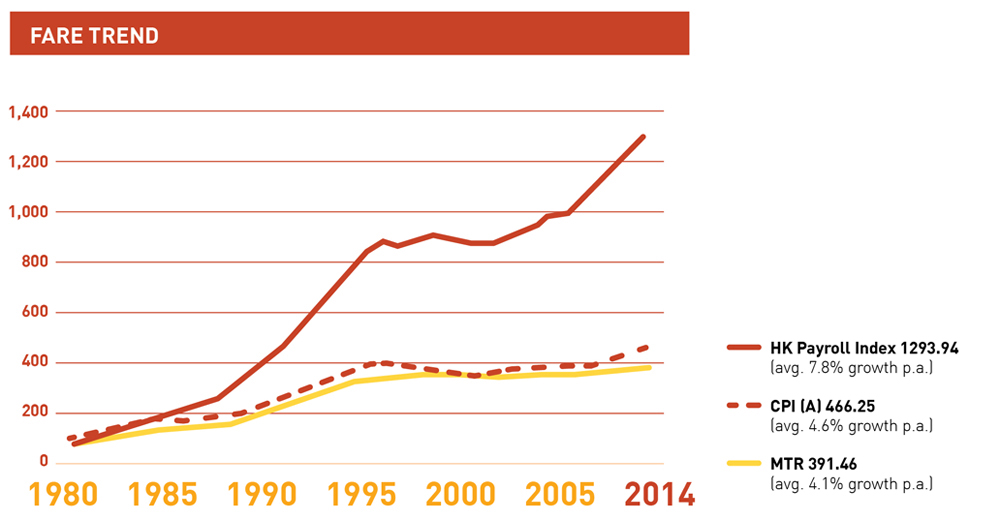

In Figure 8 below, MTR published that CPI had grown an average of 4.6% pa while Hong Kong’s payroll grew at 7.8%. Its fares had been climbing slowly with CPI at 4.1% pa (lagging wage growth) over the past 30 years.

Source: Company’s website

The FAM helps buffer MTR’s revenue. On one hand, it limits MTR’s downside risk when expenses and wage rocket. On the other hand, it restricts MTR’s ability to raise its fares, capping its revenue. Hence, in order to expand its revenue, MTR has to increase ridership. One way of increasing ridership is by growing Hong Kong’s population (a great challenge for Hong Kong!), the other is by adding more stations.

Current Railway Expansion Plans (2016 – 2021)

Based on MTR 2016’s Annual Report, the total length of Hong Kong’s metro railway line is approximately 230.9km. It has 93 stations and 68 Light Rail stops. The average daily patronage exceeds 5 million, accounting for about 48% of the public transport patronage and more than 60% of the cross-boundary passenger land trips between China Mainland and Hong Kong.

In a government study commissioned in 2000, it stated that the aim of railway networks and its future extensions were to fulfill the following objectives:

- Relieve bottlenecks

- Provide rail services to strategic growth areas for housing and economic development

- Meet cross-boundary passenger and freight demands

- Increase railway share in the overall transport system to reduce reliance on road-based transport

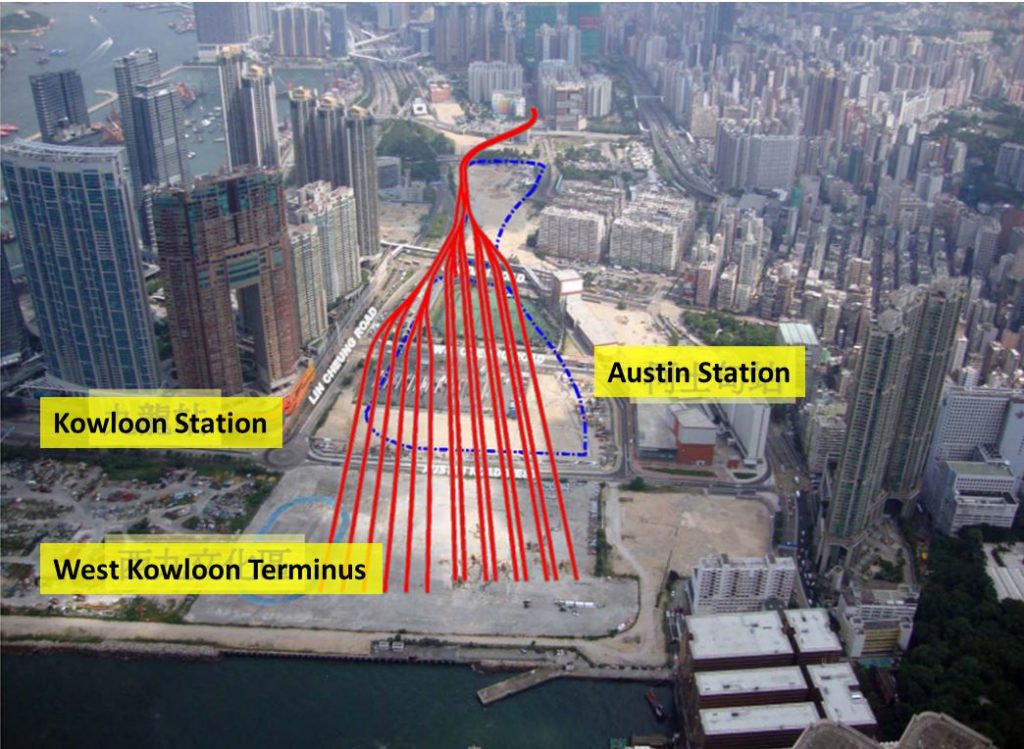

The study led to the approval of five railway projects, which are currently standing at different stages of implementation. These are West Island Line, South Island Line (East), Kwun Tong Line Extension, Guangzhou-Shenzhen-Hong Kong Express Rail Link (see Figure 9 below), and Shatin to Central Link. Based on the latest assessment, some of these lines were completed or expected to be commissioned in succession between now to 2020/2021. By 2021, there are plans to increase the number of stations to 99 and rail length to 270km, a 13% & 22% increase respectively.

Source: Briefing Slides to HK Legislative Council

Future Railway Expansion Plans (2021 – 2031)

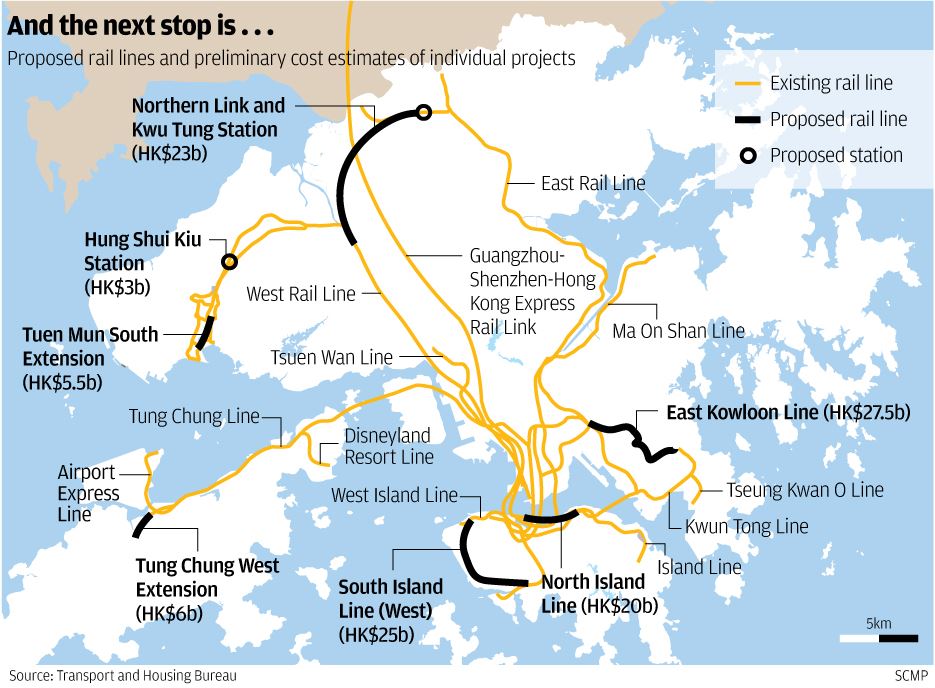

Another study by the Hong Kong government released in 2014 stated that the number of stations in the whole railway network will increase from 99 in 2021 to 114 in 2031 (18% increase), stretching total rail length from 270 km to 300 km (11% increase), opening up previously inaccessible areas, enhancing connectivity further (see Figure 10 below). It aims to achieve rail share in the public transport by more than 50% in 2031. Total project funding will approximately amount to HK$110 billion, considering 2013 prices.

Source: South China Morning Post

Based on current railway expertise, there are no major competitors in Hong Kong against MTR. With a strong government ownership, MTR will profit greatly from these rail expansions, barring new entrants and adverse economic conditions.

Byte Sized Conclusion

In conclusion, MTR’s ability to achieve a high patronage of 1.9 billion users in 2016 was attributed to several factors, i.e. being an economical and efficient way of mass-travelling, Hong Kong’s limited developable land, and multiple bottlenecks for commuting, compels the HK government to encourage MTR as the primary means of transport. The government, being the biggest stakeholder in the company, will also continue to invest and grow the railway lines. These are MTR’s first competitive advantage and they seems poised to benefit from all these factors.

Reference:

- Hong Kong Public Transport Study (June 2017)

- Railway Development Strategy 2014 (September 2014)

- Railway Development Strategy 2000 (May 2000)

- Legislative Council Briefing on West Kowloon Terminus (November 2009)

- Census and Statistics Department of Hong Kong

- MTR 2016 Annual Report

- MTR Company’s Website

STAY TUNE FOR MORE MTR ARTICLES!

We will continue to break down MTR’s operating segment and study them in detail to understand MTR’s competitive advantages and how it commanded such respectable growth and margins.

Today’s article explored MTR’s transport operation’s competitive advantage in Hong Kong; to allow it to become the nation’s most preferred mode of transport.

Next we will explore MTR’s second competitive advantage, which allows it to command above 80% of gross profit margins in its property business.

We will also cover its overseas rail and property operations and compare MTR’s key metrics with some of the listed peers in the region. With the “One Belt, One Road” Initiative and its existing dealings with China, MTR seems to be poised to benefit from the new Silk Road.

If you like the upcoming articles, do like our Facebook page or sign up for our newsletter!

Note: Byte Sized Investments has vested stakes in MTR.

If you are into investing and like to know what the gurus think of the market right now, here’s one event coming up that YOU SHOULDN’T MISS: InvestX Congress. It’s an event for retail investors like you and me to gather to learn what’s working NOW in the investment world… it’s not about theory; everything’s “Been there, Done that”. Don’t hesitate, click here to get your tickets NOW!