This is one simple way to maximise your CPF

In this short article, we will share 1 method you can do from now till age 55 in order to maximise your CPF. We will then share what you can do from 55-65 years old to maximise your retirement nest. We provided some numbers to substantiate our beliefs.

Here’s 2 simple facts you need to know before we proceed:

Fact #1: CPF SA compounds at a risk free interest of 4-6% per annum.

We have spoken on the power of compounding previously. 4% may sound small but compounding $50,000 at 4% for 30 years will become $172,000 with no addition capital put in. That’s $122,000 of interest earned! The longer you compound, the better.

Fact #2: You can draw out ALL^ the money in your CPF OA and SA after setting aside the required sums into your CPF RA and BHS^^.

After setting aside the required sums into your CPF RA, you can (immediately/slowly) withdraw the money from your CPF SA and OA.

^The funds from CPF SA Cash Top up will be set aside specifically for CPF RA and cannot be drawn out. This shouldn’t be an issue since you are not allowed to do CPF SA cash top up beyond FRS. Thus, you will never put in more than the amount required (FRS) to be set aside into the CPF RA.

^^Basic Healthcare Sum. The amount you need in your CPF MA at age 55. You can refer the link here for more info. (Added for better clarity; Credit Sinkie)

Here is one method a Singaporean who works hard but does not/do now know how to invest can do to maximise his retirement nest:

By transferring the money that you want to set aside for your retirement (money you don’t need for a long time) into CPF SA during your working years, and withdraw them from age 55. You can use CPF SA to help grow your retirement nest and fund your expenses after 55 years old (which is what CPF was conceived for in the first place).

Its no secret…It’s really that simple!

Let us show you some examples.

Leveraging on CPF SA to maximise returns for withdrawal at age 55 (now till age 55).

Let’s assume a median income earner who takes home $51,000 a year. At age 31, he is estimated to have accumulated about $11,000 in his CPF SA. Assuming he contributes about $250 per month into his CPF SA and worked till age 55 with no wage increment. He would have $158,000# by age 55. However, this is barely enough to even meet (today’s) FRS.

Now assume he does an additional CPF SA cash top up of $580 a month (to max the contribution for tax incentive), on top of his income contribution. This is money he is able to set aside for his retirement with no impact to current lifestyle. His monthly contribution would then be $830. He will have about $350,000 in his CPF SA at age 55*.

#Note: The calculation of CPF RA may differ due to the difference in period used for computation of the interest. Monthly computation of interest will result in a higher interest compared to a yearly computation. Crediting interest at the start of the month/year versus the end of the month/year would also make a different.

*Note: You are not allowed to do anymore CPF SA Cash top up once your CPF SA balance hits the FRS for that year. So with a CPF SA Cash top up of ~$7,000 a year, our median income earner can only top up till age 48. At age 48 his balance in CPF SA would have exceeded the FRS for that year (considering age 31 is pegged to 2015’s FRS of $161,000).

To keep the calculations for CPF RA conservative, we omitted CPF OA into the equation since it could be used for other purposes such as housing, education, etc.

Median Income Earner ($51,000 a year)

| Without CPF SA Cash Top Up | With CPF SA Cash Top up | |

| CPF SA balance at 55 | $158,000 | $350,000 |

| Total Contribution | $86,000 | $204,000 |

| Mandatory Contribution | $86,000

($250/mths x 12 mths x 25 yrs + $11,000 starting CPF SA) |

$86,000

($250/mths x 12 mths x 25 yrs + $11,000 starting CPF SA) |

| CPF SA Cash Top Up | 0 | $118,000

~(580/mth x 12 x 17 years) |

| Interest earned at age 55 | $72,000 | $146,000 |

Estimated amount available to draw out after setting aside BRS

#Assumed BRS at 55 (2040) is $140,000 |

$18,000 | $210,000 |

As you can see from the above table, if you set aside amount that you don’t need into CPF SA and allow it to grow, you would be able to enjoy a bigger sum at age 55 for your retirement.

This is not inclusive of the potential tax saved over the years due to CPF SA cash top. For more information on tax savings, check our previous articles here and here.

To put it bluntly, if you had kept $118,000 idling as cash in bank or in fixed deposit, you will only have about $18,000 for withdrawals. You may not be able to stop working at age 55 unless your CPF OA is loaded. The difference of setting aside the extra $118,000 into your CPF SA against letting it idle as cash or in fixed deposit could make a difference between being able to retire and not able to retire.

Let us repeat the scenario with an average income earner who takes home $78,000 a year. Like the previous scenario, he will start with $11,000 CPF SA balance at age 31. As he earns slightly more than our median income, he will contribute $400 a month into his CPF SA till age 55 (assuming no wage increments). He will have $235,000 in his CPF SA at age 55.

We then compare if he does CPF SA Cash top up of an additional $580 a month till age 46* where his CPF SA balance exceeds the projected year’s FRS. By age 55, his CPF SA would have grown to $405,000. Noticed that our average income earner is able to draw out up to $265,000 at age 55 to fund his retirement.

Average Income Earner ($78,000 a year)

| Without CPF SA Cash Top Up | With CPF SA Cash Top up | |

| CPF SA balance at 55 | $235,000 | $405,000 |

| Total Contribution | $131,000 | $235,000 |

| Mandatory Contribution | $131,000

($400/mths x 12 mths x 25 yrs + $11,000 starting CPF SA) |

$131,000

($400/mths x 12 mths x 25 yrs + $11,000 starting CPF SA) |

| CPF SA Cash Top Up | 0 | $104,000

~(580/mth x 12 x 15 years) |

| Interest earned at age 55 | $104,000 | $170,000 |

| Estimated amount available to draw out after setting aside BRS

#Assumed BRS at 55 (2040) is $140,000 |

$95,000 | $265,000 |

CPF cash top ups is just one of many ways you can make the money in CPF SA work hard for you. You can also do voluntary contributions, where you out money in proportion into all three CPF accounts. You can also do CPF OA to SA transfer. Any of this method would help you maximise the compounding interest.

This could be on-par/better than some of the annuity plan you buy from the market!

Like what you are reading so far? Sign up for our newsletter to receive future blog posts!

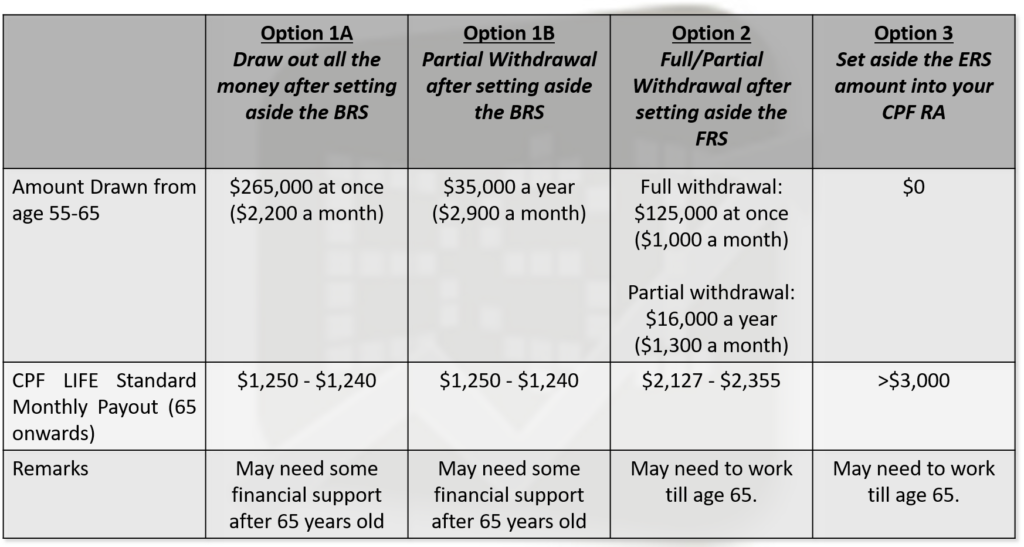

Maximising your retirement after 55 years old with CPF LIFE (55 – 65 years old)

Let’s assume your CPF SA balance at age 55 is $405,000 (average income earner) and you chose to stop working. As mentioned in the flowchart we shared in our previous blog, at age 55, you may:

- Pledge your property and draw out all/some of the money after setting aside the BRS in the CPF RA. The remaining amount in your CPF OA & SA will continue to generate interest. You may draw anytime after that.

- Set aside the FRS into your CPF RA and draw out all/some of the remaining money. The remaining amount in your CPF OA & SA will continue to generate interest. You may draw anytime after that.

- Set aside the ERS into your CPF RA and draw out all/some of the remaining money. The remaining amount in your CPF OA & SA will continue to generate interest. You may draw anytime after that. (In this scenario, after ERS is set aside, there is none left in our CPF SA)

What is FRS, BRS, ERS? What is CPF LIFE? Refer to our previous article

Option 1a: Draw out all of $265,000 after setting aside BRS

After pledging your property and setting aside the BRS into your CPF RA, you may draw out ALL $265,000 for your monthly expenses for the next 10 years. With $26,500 a year, you will have about $2,200 a month. By age 65, CPF LIFE will commence and you can rely it for your expenses. If you had selected CPF LIFE Standard, your payout would be $1,250 – $1,240. Depending on your lifestyle, you might not be able to rely solely on your CPF LIFE payout.

Option 1b: Partial withdrawal of $35,000 a year after setting aside BRS

After pledging your property and setting aside the BRS into your CPF RA, you decided on partial withdrawal instead of lump sum withdrawal. By doing so, you realised that you are able to withdraw $35,000 a year for 10 years, a higher amount compared to Option 1a ($35,000 a year would give you $2,900 a month). This is because the amount left in your CPF SA balance after you withdrawn your first $35,000 continues to generate interest. That is why the total amount withdrawn over 10 years is much more than in Option 1a.

Option 2: Full/Partial Withdrawal of the money after setting aside FRS

After setting aside ~$280,000 (estimated FRS in 2040), you have about $125,000 left. There’s nothing much you can do with $125,000 for 10 years unless (1) you have surplus CPF OA that you can drawdown from or (2) continue to work and generate income. However at age 65, because you set aside the FRS, your CPF LIFE payout would be $2,127 – $2,355. If you don’t mind working longer, you enjoy a higher payout compared to Option 1.

Option 3: Set aside the ERS amount into your CPF RA

After setting aside all ~$405,000 (estimated FRS in 2040 is $420,000), you have nothing left in your CPF SA. Like in Option 2, there’s nothing much you can do unless (1) you have surplus CPF OA that you can drawdown from or (2) continue to work and generate income. However at age 65, because you set aside the ERS, your CPF LIFE payout would be well over $3,000^^. If you don’t mind working longer, you will enjoy a higher payout.

^^Based on CPF LIFE payout estimator, a $350,000 CPF RA balance at age 55 for 2017 will allow $2,618 – $2,900 of monthly payout. The estimator currently is unable to estimate any amount above $350,000.

Note that these scenarios were ran against average income earner of $78,000 a year with no wage increment. In reality, with bonus, wage increments, CPF OA surpluses, it is possible to have a higher withdrawal amount from 55-65 or to set aside the ERS in your CPF RA to enjoy a higher payout to pursue a more comfortable retirement lifestyle.

However, if you have intention to retire at age 55 and choose to pledge your property to get more cash earlier (Option 1), you may find that that income after 65 may not be adequate. This is because inflation would have caused prices to be much higher than today. Thus ~$1,000/month may not be enough. We have scheduled an article to propose a solution to you on how you can supplement your income after 65.

Alternatively, instead of putting money into your CPF SA to grow at 4%, you can invest to get a return higher than 4%. If you don’t know how to invest and want to start learning how, you can click here to find out how you can do it.

Byte Sized Takeaway

As you can see, if you plan to set aside money for retirement (but don’t have time to invest), then you may want to consider putting your money in CPF and allow it to grow. If you do so, at age 55, you will have a larger egg nest then if you left the money in your bank or in the fixed deposit.

Also, you are able to withdraw more by doing partial withdrawals than compared to a lump sum withdrawal at age 55. This is because you only draw enough for a year and allow the money in your CPF SA balance to grow.

If you can afford to set aside the ERS into your CPF RA, you would have much more money at your disposal once LIFE payout commence.

We would be publishing more articles on how your can hack your personal finance, so do like our Facebook page or sign up for our newsletter!

2 Comments

2 big corrections:

1) for Fact #2 — You can withdraw your excess OA & SA only after meeting the required FRS/BRS **AND** the Basic Healthcare Sum (Medisave). BHS is about 25%-33% of the total amount needed to be retained in CPF at 55 yrs old.

2) Voluntary retirement sum top-ups to SA **CANNOT** be withdrawn when you reach 55. This is the kicker that almost all don’t know about. All direct voluntary top ups to SA **MUST** be used for CPF Life. Why do you think govt give you income tax benefit for this?!?!?! No free lunch!!!

OTOH if you do generic voluntary top up to CPF — which gets distributed into OA, SA & MA as per normal, then any excess SA above the FRS/BRS & BHS can be taken out, even if the $$$ comes from the generic CPF voluntary top up. However, you don’t get any tax benefit for such generic voluntary top up.

Confused??? Heheh … You need to read all the fine prints & FAQs in CPF website.

Hi Sinkie, you are correct to point out that Cash top up cannot be withdrawn at 55. To know all these “fine prints”, you must be pretty savvy with CPF! 🙂

We mentioned it in our “^” right under Fact 2.

We saw those fine prints on CPF’s website and clarified with CPF. Their rationale is that cash top up is for retirement, hence it *cannot* be withdrawn. With that, the fear is that you can’t withdraw the amount that you want.

Here is 3 points we put together:

1. The cash top up cannot be withdrawn, but the interest from the cash top up can be withdrawn.

2. We can never do CPF SA cash top up into CPF SA exceeding the FRS. (If you have mandatory contribution your CPF Cash top up will always be lesser than FRS)

3. CPF will set aside the FRS into your CPF SA at age 55, with a minimum of BRS if property is pledge.

Hence, the only time when we can’t withdraw the amount cash top ups into our CPF SA is when we top up more than the BRS at the age of 55.

For example. Over the past 30+ years of working I contributed SA Cash Top up of $90,000 and my total CPF SA balance is $200,000. In 2017 at age 55 (BRS: $83,000, FRS: $166,000), I have to set aside the FRS of $166,000. If I want to pledge my property and get more money out, I can only withdraw $110,000 instead of $117,000 (200k-83k) since the $90,000 I have contributed via top up cannot be withdrawn. This is the only scenario when you might put in more than what you want to get out.

The idea of the post is to share how we can make CPF work hard for us, instead of we working hard for money. We want to use top up to quickly gain a larger base for the 4% risk free interest to compound and accelerate our CPF balance. The examples were simplified (omitted OA & SA, however, we noted your point and added that into Fact 2) to illustrate the difference on how you can use CPF SA to help grow your retirement nest. If we have the means we should start to take action in our earlier years (rather then let the cash idle in Fixed Deposit, Banks, or invest haphazardly); we belief we will be in a much better position.