5 things I learned at First REIT’s EGM

First REIT recently released the results of the EGM that was held on 29 Dec 2015. The resolution was to seek shareholder’s approval of the proposed asset swap of Siloam Hospital Surabaya (SHS) with an interested person (Lippo Karawaci, First REIT’s sponsor). 98.26% voted for the resolution.

It was quite a resounding vote. So what was in the deal that made it so attractive?

What’s the deal about?

It is an asset swap of an aging hospital, Siloam Hospitals Surabaya (SHS) to a new one.

Basically First REIT will be getting a spanking new hospital almost 3 times the current size of the hospital, furnished with state of the art medical equipments. It is achieved by selling the old aging SHS back to Lippo Karawaci (LP) for them to redevelop it into a mixed development, comprising of a new hospital, private school, mall, hotel, apartment and a carpark.

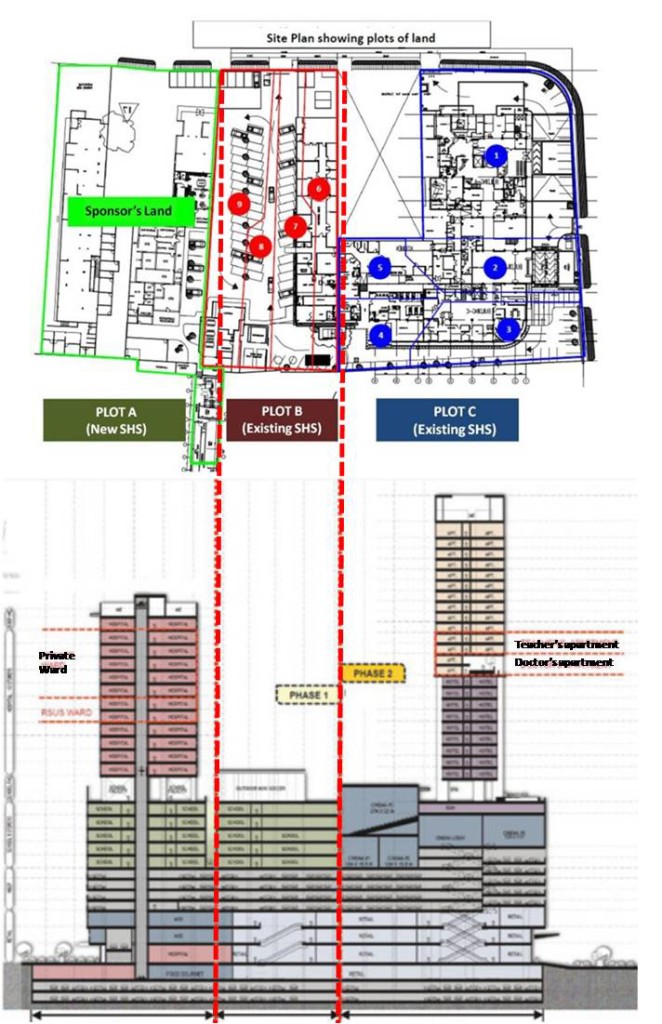

To get the new hospital, First REIT will have to first sell the plot of land that the carpark sits on (see below diagram Plot B) for LP to commence construction of the new hospital on both Plot A (land which LP already owns) and B. Once the new hospital is completed, First REIT will sell its old SHS hospital (Plot C) and acquire the new SHS hospital at S$90 million. First REIT will sell Plot B & C to LP at a total of S$35.7 million. The whole development is projected to be completed in 3.5 years.

Above is the artist impression of the development.

So what’s in it for First REIT and how you as shareholders will benefit from this deal? Here’s 5 things I learned about the deal.

- First REIT was able to negotiate a very good price for the deal.

First REIT previously acquired SHS (carpark inclusive) for S$16.8 million. It is currently valued at S$33.2 million, almost double the price it was acquired. You can gather the justifications of the valuation in Annex D of the Circular. But that’s not it. First REIT will be selling SHS (carpark inclusive) at above-valuation of S$35.7 million, realizing a profit of 112%!

Not only did they manage to sell their existing properties at a 7.53% premium over its valuation,they got a bargain for the new hospital they bought. Valued at S$102.3 and $103.0 by Jones Lang LaSalle and Knight Frank respectively (see circular for valuation), First REIT got the new hotel at S$90 million, a 14% discount!

A shareholder should be delighted that First REIT’s management did not bend to the will of their sponsors, and was able to negotiate such a good deal for the shareholders.

- A win-win deal.

Of course one would ask how the management of First REIT pulled off such a feat. Is it a scam? How would LP explain to their own shareholders that they bought at a premium and sold at a discount? Until LP make any news release, we will never know.

What we can interpret from management’s response was that the deal creates a great value for LP since the development revitalized the area from just a hospital and a carpark into a community with residential apartments, school, shopping mall, hotel and the hospital. With such an integrated development, the overall traffic and eventual value of the area will inevitably increase.

The teachers and doctors now are just a stone’s throw from their workplace with the convenience of the mall.

The sale of the residential apartments and probable REIT-ing of the mall to Lippo Mall Indonesia REIT (LMIR) could create an instant windfall while the income from the hospital and hotel could create recurrent income for LP.

With such value created for LP, surely LP will be able to provide such generous offer to the shareholders of First REIT.

- First REIT achieved a rental yield of 14.9%.

Currently, the tenant, Siloam, is paying an annual base rent of S$3 million. Upon completion of the new SHS, Siloam, will be paying a base rent of S$8.1 million for the right to operate the hospital. This is a 170% jump in rental income for First REIT!

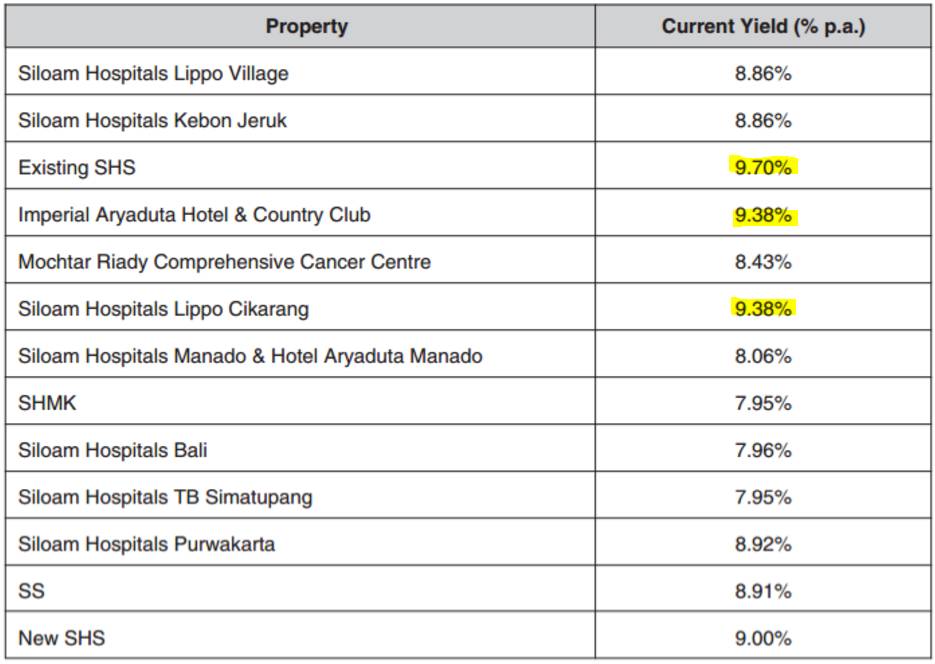

Take note that they are getting S$8.1 annual base rent for S$90 million, which comes to about 9% rental yield. Comparing that with the other rental yield First REIT is getting from the other properties, only 3 other properties gave a higher yield.

Of course, one might opine otherwise, First REIT is giving up a 9.7% rental yield for a 9%. It is not wrong to think of it this way. However, which would you choose a property with base rent of S$3 million yielding 9.7% or a property with base rent of S$8.1 million at 9%? The answer differs from one person to another, but it is very dependent on one’s capital and the opportunity costs.

However, to an experienced investor, there is one perspective that might tilt shareholders’ favor. The yield is 9% based on the purchase price. This is based on financial accounting policies and guidelines. As such, First REIT err on the side of caution by publishing these figures. Just like how Buffett published his statements based on Generally Accepted Accounting Policy (GAAP), he also shares his own set of managerial accounting statements, like the Look-through earnings (Point 6 of the Owner’s Manual).

Should we take the whole deal in totality, net of its sale of Plot B & C, First REIT is essentially paying only S$54.7 million. Collecting S$8.1 million annual rent on S$54.7 million investment, that gives a whopping 14.9% rental yield! Do not forget the calculation has yet to factor eventual rental increment! This is indeed a yield accretive acquisition.

- There will be no disruption in the DPU.

When Suntec City Mall underwent AEI, its rental income decreased, resulting in lower DPU. This could be one of the possible causes for the share price to temporarily drop.

During the EGM, First REIT management repeatedly explained that there will not be any disruption in the DPU.

How can this be done? Is it too good to be true? Sounds like you can have your cake and eat it.

Earlier, we mentioned that SHS would continue to operate on in the existing SHS hospital as the new one is built. Only when the new hospital is completed, First REIT will shift the operator to the new hospital before selling the existing old hospital to LP. Refer to page 9 and 10 of the EGM presentation for the timeline.

Furthermore, the rentals will be in denominated in Singapore Dollars, this means that there is little to no risk on foreign exchange.

What management is telling us is that with no disruption in DPU, share price should remain stable.

- Overall characteristics of the portfolio improved.

With the acquisition, the quality of the enlarged portfolio also improves.

| Before Acquisition | After Acquisition | % Change | |

| Total Gross Floor Area (GFA) /sqm | 251,339 | 266,358 | ↑ 6% |

| Projected Gross Revenue / S$ million | 93.26 | 98.22 | ↑ 5.3% |

| Distribution per Unit (DPU) / S$ (for 9 mths ended Sep 15) | 6.21 | 6.58 | ↑ 6.1% |

| Weighted Avereage Lease to Expirty (WALE) / years | 10.8 | 11.3 | ↑ 4.6% |

| Weighted Average Age of Properties (WAAP) / years | 10.1 | 8.2 | ↓ 18.8% |

| Net Asset Value (NAV) / cents | 102.02 | 104.04 | ↑ 2% |

As you can see, with the impending project to be completed in second half of 2020, First REIT’s portfolio will be enlarged and newer. It also has a longer average lease with higher revenue.

Conclusion

There were also other pointers raised during the EGM, such as giving up ownership of the land for a strata-titled deed, etc. However, investors are always asking for more and it is up to the management to meet the expectations yet at the same time, be accountable to the shareholders.

An asset enhancement initiative deal which is yield accretive, with no disruption of DPU are hard to come by and we think First REIT managed to create a deal that is win-win-win for both the shareholders, sponsors and management.

If you like our articles, do sign up for newsletters NOW!!

Note: Vested. Please exercise independent thinking.